When NOT To Use Hard Money For Real Estate Investing

Every form of leverage has its time and place. Here’s when not to use hard money.

You need all kinds of leverage as a real estate investor. Different investment problems will call for different kinds of debt solutions.

Hard money, banks, private equity, and OPM all have their time and place. However, there are times when certain lending methods just aren’t smart.

Hard money has a lot of important uses, but when should you not use hard money?

1. When It Costs More

The main time when not to use hard money is whenever it’s the more expensive option.

You get into real estate to make money. Saving money on the leverage for a deal is a top priority.

Hard money is one of the most expensive forms of leverage. If using hard money costs you more than any other lending option, that’s your first sign not to use hard money.

When Is Hard Money More Expensive?

Private equity funds and hard money lenders typically have around the same pricing. The real gap comes when you compare bank loans to hard money.

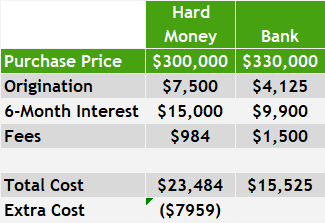

In a previous article about when you should use hard money, we went over an ideal situation for hard money. In this example, the speed of a hard money loan can get you such a good deal on a property that you wind up saving money.

However, that doesn’t always happen. The cost of the property might not change whether you have a hard money loan or bank loan. You might have plenty of time to wait for the cheaper but slower loan from the bank. In those cases, you almost always should not use hard money.

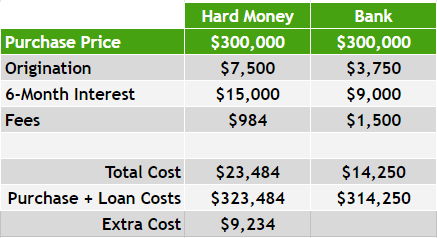

The interest rate and origination fee for hard money will almost always make it the more expensive loan. Here’s a side-by-side comparison of a hard money loan vs bank loan for the same property.

As you can see, when all else is equal, a hard money loan would cost you over $9,000 more.

Always, always go with the cheapest source of funds. In typical situations, bank loans and OPM will be cheaper than hard money or private equity.

2. When You Have Time

If speed isn’t a factor in getting a good deal, that’s a sign when not to use hard money.

Sometimes, speed at closing can mean the difference between getting a property and not getting it. Or, closing fastest could mean saving tens of thousands of dollars on a deal. Hard money is a good option then.

However, that’s not always the case. Sometimes a seller is willing to wait several weeks for a bank loan to clear in order to take a higher bid.

If time isn’t a consideration, then you probably shouldn’t use hard money.

3. When You Have Real OPM

OPM is money you get from real people you know. If OPM is available to you, you should always use it instead of hard money.

This form of leverage combines the speed and flexibility of a hard money lender with the price (or cheaper) of a bank loan.

If you can source and secure an OPM loan for a project, then there’s usually no reason to get hard money.

4. When You Already Have Money

It’s never smart to use a hard money loan when you already have cheaper funds available – especially when you have cash.

There’s no reason to pay a 9% interest rate when you could pay with a 0% rate, or use a cheaper line of credit like a HELOC.

A time when not to use hard money is when you have an equally flexible funding source that costs way less. In general, when you have cash available, stay away from leverage at all.

How Else Do I Know When Not to Use Hard Money?

What’s the right leverage for you? Are you doing it right? Are you using the best funds for your project?

Join our weekly call-in here, every Thursday at 1:15 PM to 2:15 PM MST to find out! Bring a specific question about a deal, and we can talk through the best option for you.

Happy Investing.