5 Times You Should Use Hard Money for Your Real Estate Investments

Here are 5 ways to use hard money right as a real estate investor.

Real estate investing is all about making profit.

And sometimes, to make profit, you need to use hard money loans.

When is hard money your best option in real estate investing? Let’s look at 5 situations where you should use hard money to fuel your investments.

1. Using Hard Money for Speed

The number one way hard money makes you money in real estate investing is how fast they are.

Look at a real example from one of our clients.

He was able to buy a property in Colorado at a $30,000 discount.

Five other people were bidding as high as $330,000 on the property.

But our client was able to close in less than a week, so the sellers accepted his bid of $300,000.

How Much Does a Hard Money Loan Cost?

People can get tripped up with the cost of hard money. Wouldn’t the price of the loan leave our client at a loss here? Let’s compare his hard money loan on this deal to his competitors with a bank loan.

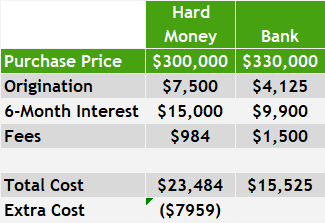

For hard money, he spent $7,500 on origination. A bank loan would have cost $4,500.

Six months’ worth of interest on the hard money loan adds up to $15,000. The same time on a bank loan would accrue $9,900 of interest.

Appraisal underwriting, and processing fees were lower with hard money at $984 (vs $1500 with the bank.)

Overall, our client did pay a lot more for the loan itself using hard money. His hard money loan cost $23,484, and a bank loan would have cost $15,525. That’s an extra cost of $7,959 to use hard money.

Can You Save Money by Using Hard Money for Real Estate?

Despite seeming more expensive, hard money still gave this investor a discount. Why? Hard money enabled him to close fast, so he got a better deal on purchase price.

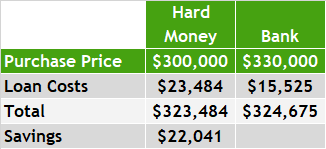

What was the total cost of hard money? The discounted price of the property ($300,000) plus the hard money loan costs equals $323,484.

What about the bank loan? The home price of $330,000 plus bank loan costs totals $345,525.

This is a savings of $22,041. Just for closing fast with hard money rather than using the cheaper but slower bank loan.

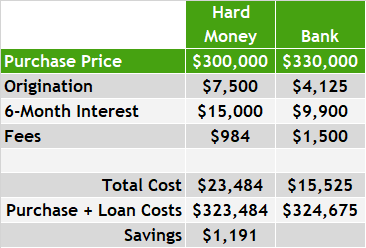

Using hard money for speed works even when the discount is smaller.

Let’s say our client had bid only 10,000 less than the other investors. He still would’ve saved $1,191 up front on the deal.

Hard Money Savings without a Purchase Price Discount

The option of buying real estate with bank loans is often cheaper. However, in many investment situations, using a bank loan is not a viable option.

If you have to wait 4 weeks to clear your bank loan, but only 4 days for a hard money loan… that becomes the difference between closing on the property or not.

Ultimately, even if using hard money doesn’t get you the lowest price, you still save money in the long run. If the speed of a hard money loan gets you a property, you will still come out on top.

Buying then selling a profitable fix-and-flip will always make more money than never buying and never selling.

2. Use Hard Money if You Have Low Credit

Institutional lenders, private equity, and banks have credit score minimums. If you don’t have a high enough score, you don’t get a loan.

Hard money lenders, on the other hand, are typically not credit-score-driven. Yes, they’ll probably look at your credit, but they won’t base your loan on it.

Real estate investors can have low credit scores for many reasons:

- Usage – You put your flip rehab costs on credit cards

- Thin Credit – You have few lines of credit, or young lines of credit

- One-time Event – You had good credit, then life happened and your score temporarily dipped.

Hard money lenders understand that these issues are not always a reflection of your ability to pay back loans.

That’s why hard money lenders don’t worry about your credit score, just your credit.

Do you have a history of late payments? Are you defaulting? That will negatively affect you with a hard money lender.

If you are responsible with credit, but have a score banks won’t accept, a hard money lender will be a good option.

3. Using Hard Money Because It’s Flexible

Sometimes you need an outside-of-the-box lender.

- Unique Properties – If you have a house or area that’s unique (maybe a dome house, an old manufacturer, etc.), hard money lenders will give you more options.

- Rural Areas – Most local banks and large hard money lenders don’t lend outside of MSAs. Traditional lenders might not cover thirty miles outside of an urban area, but many small hard money lenders will.

- Cross Liens – Hard money lenders have more flexibility putting a cross lien on another property. This is useful if you don’t have a lot of money to put down, but do have another property with a lot of equity.

- Gap funding – Sometimes a mortgage doesn’t quite cover all the costs of your project. Hard money can fill in those gaps.

- Lot splits – Splitting off a lot can be a headache with a traditional lender. A hard money lender is more flexible with the time it takes to get a survey and everything else prepared. This allows you to split off a lot, sell the house, and keep the lot.

4. Using Hard Money for BRRRRs

Hard money is crucial for successful BRRRRs.

With BRRRR (rental flips), you:

- Buy undermarket valued properties

- With a hard money loan

- Then rate-and-term refinance into a longer-term loan.

If you want to get into BRRRR transactions (rental properties), you have to find a hard money lender or private lender who will loan you 75-80% of the after-repair value of the property you want to buy.

If you get a hard money loan to fund the purchase price and rehab up to 75-80% ARV, you can maximize your refinance. This saves you money, time, and interest.

5. Other Times to Use Hard Money

There are many other reasons real estate investors use hard money. Here are a few:

- Banks limit you to 2-3 loans. If you’ve maxed out those lenders, hard money can help.

- Hard money can work as a bridge loan. It covers the down payment of your next property until your other bank-funded property sells.

- You can keep a project off your credit. Hard money typically doesn’t show up on your credit report.

- Investment beginners might need help with their first couple projects started before banks will lend to them.

- Complete a started project. If you end up with a property mid-flip, many banks won’t lend for it. But a hard money lender can easily provide a gap loan to finish the rehab.

- Hard money has the flexibility to let you come in with other funding sources. (If you want to put repair costs on a credit card, want to use an OPM lender, etc.).

How to Use Hard Money for Real Estate

Want to learn more about real estate funding? Wondering if a hard money loan might be right for your investment?

Email us your questions anytime at Mike@HardMoneyMike.com.

Or join our weekly Leverage Up call here, every Thursday from 1:15 PM to 2:15 PM (MST).

Leave a Reply

Want to join the discussion?Feel free to contribute!