3 Ways Banks Trap Real Estate Investors in Pricey Loans (and How to Get Out)

Credit, banks, and real estate investors: 3 traps and how to avoid them.

As a real estate investor, you always want to minimize costs. This includes the costs of the money itself.

However, banks can trap real estate investors into paying more than they should. You could be paying 1-4% more in rates, 5-10% more on down payments, or could even be denied altogether.

These three traps all come back to what we call the usage circle. Let’s talk about what the usage circle is and how it affects real estate investors.

The Usage Cycle: How Banks Trap Real Estate Investors

Here’s how the usage circle goes:

- A real estate investor uses their credit cards to keep a project going. They pay for materials, labor, expertise, and more on their cards.

- They will pay the card off after the real estate transaction. When they close or refinance a deal, they’ll wipe the card back to zero.

- But while they’re using the card, their credit score will drop. When they pay off the card, their score will go back up.

- Banks still use the current, low credit score when they give you the loan.

And there’s the trap.

Using credit to buy the stuff that keeps your business going pulls down your credit score. But with a bad credit score, you can’t get the loans to keep your business going.

How Credit Usage Impacts Loans

Usage makes up 30% of your FICO credit score. When an investor is using a lot of their available credit, their score takes the hit.

The difference between a 679 and a 680 score can mean the difference between getting a conforming conventional investor loan or getting declined.

You’ll pay off your credit once you sell or refinance your investment property and your score will go back up. Banks know this, but they can’t take it into account. They have to use your current credit score when you apply – even if it’s only low because of high usage on business costs.

Here’s how banks leave real estate investors trapped in this way.

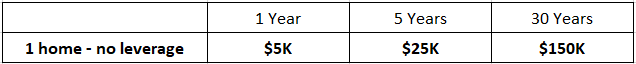

1. Higher Interest Rates or Loan Costs

If your credit score is down due to high usage, you’ll end up paying an extra 1-4% either on your interest rate or loan costs. On a $400,000 project, this can add up to an extra $4,000 to $16,000 just for one transaction.

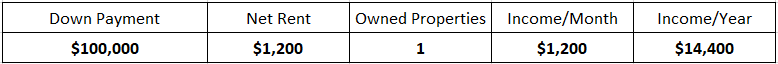

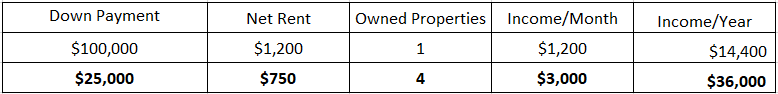

2. More Money Down

Banks may require you to put down 5-10% more on a property if your credit score is low. On a $400,000 transaction, this means you’ll have to bring an extra $40,000 out of your pocket. This unexpected cost could prevent you from doing the deal in the first place.

3. Loan Denial

Banks may decline a real estate investor’s loan if their credit score is even just one point below the bank’s guidelines. If you can’t get a loan, you’ll be locked out from getting a rental property, flip, or other investment opportunities.

Solution to the Banks’ Real Estate Investor Credit Problem

The credit score usage trap is real. It happens to almost 80% of the clients that we see.

The solution to avoiding the credit score usage trap is simple: stop using your personal credit cards for business use. If your credit usage is in your business’s name, then it won’t impact your personal credit score.

Here’s the method we recommend.

How to Move Your Credit Usage from a Personal to a Business Credit Card

If you have an LLC set up, you’re already working as a business, and your usage is impacting your personal credit score, then you can move the debt.

You can pay off the credit card balances using a private loan. This usually looks like having a family member or friend provide the funds.*

Then, you let the credit cycle through 30-90 days to allow your score to go back up. Once your score is settled, you can apply for a business credit card and move the balances over.

*If you don’t have someone you can ask for a private loan to do this, reach out to us. We do this type of loan all the time for our clients. We don’t want credit to be the reason you can’t flourish in your real estate investing career.

Stop the Banks’ Usage Cycle Trap for Real Estate Investors

It’s important to choose the right credit card. Some business cards do still show up on your personal credit. Do not choose this card – it defeats the whole purpose!

Not sure which card to pick? We have a link on our website to a business card that we use ourselves and highly recommend. If you get it, we’ll give you $250 off the next loan you do with us.

Tricks and tools like this are what set apart successful investors. Don’t let credit and banks trap you in pricey loans!

Happy Investing.