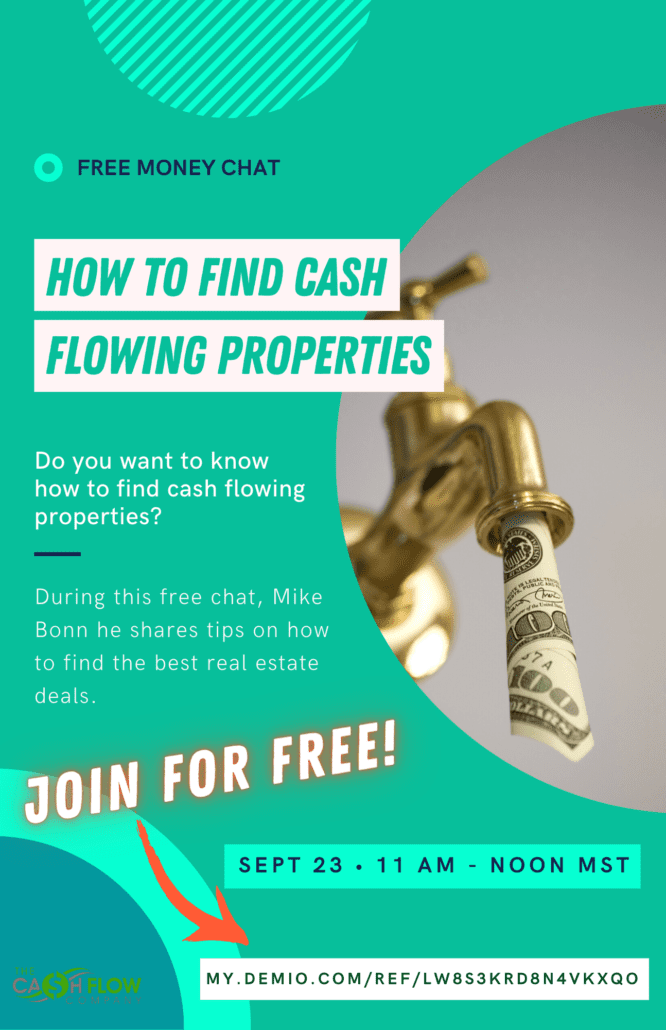

Money Chat: How to Find Cash Flowing Properties

Money Chat: How to Find Cash Flowing Properties

During our next Money Chat, real estate expert Mike Bonn will discuss how to find cash flowing properties.

Because it’s important to understand how to invest in good, cash flowing properties before putting your hard earned money into real estate deals.

You can join other like-minded investors and ask all of your questions about finding the best deals out there.

Want to join Mike’s Money Chat? Then register for FREE here.

Mike will answer common questions like:

- How do I find properties in my area?

- How do I evaluate a property to make sure it’s a good investment?

- What resources can I use to help me out with this process?

By the end of the Money Chat, you should have a much better grasp of how to find and value your real estate investments, including fix and flips and rentals.

When: Thursday, September 23rd, 11 AM MST

Where: Virtual nationwide.

Register for free at https://my.demio.com/ref/lw8s3Krd8n4vKXqo

Can’t make it? No problem. We run free Money Chats every week to make sure you have an opportunity to listen, learn, and ask all of your questions.

Mike and the rest of the Hard Money Mike/Cash Flow Mortgage Company team looks forward to seeing you on Thursday.

If you have any questions about our weekly Money Chats, then our team is here to answer them any time.

Happy investing!