7 Real Estate Loan Fundamentals – Hard Money 101

For a successful investment career, start with these 7 real estate loan fundamentals.

Are you “money wise”? It’s not hard to get there. And it will save you a lot of cash down the line.

It’s like when a person who knows about cars goes to a mechanic – they have peace of mind because they understand what’s going on. If you’re not a “car person,” at the mechanic’s it’s harder to figure out if they’re telling you the truth, or just trying to sell you more than you need.

As a real estate investor, leverage is at the center of what you do. It’s like a foreign language when you first start out. But when you become money wise, the leverage in your real estate investment career is fully in your hands.

Here are 7 real estate loan fundamentals that will make you money wise.

Fundamentals of a Real Estate Deal

There’s certain information you’ll need to bring to your lender when you need a loan. If you know the answers to their questions, the time with your lender will be much more productive.

At the end of the day, lenders want to know: Do you have a good deal? (And you should want to know the answer, too!)

We’re going to dive into 7 main concepts to answer that question:

- Strategy

- Purchase Price / Contract

- Scope of Work

- Budget

- Estimated Profit / Equity

- Comps / ARV

- Exit Strategy

1. Strategy – What Is a Real Estate Strategy?

When your lender asks about your strategy, they want to know whether you’ll use the property as a

- fix-and-flip

- a rental

- or if you’re not sure yet.

What is a real estate strategy dependent on? 1) your goals, and 2) the property.

You’ll have to know the numbers to know if the property will make a good flip with carry costs you can afford, or if it would cash flow well as a BRRRR-style rental.

But how do you “know the numbers”? Let’s start with the cost of the property.

2. Purchase Price / Contract – What Are the Fundamental Numbers of a Real Estate Loan?

Your lender could refer to this as purchase price, contract, or as-is value.

In real estate investment, there’s a distinction between what you’re paying for a property and what it’s worth. The purchase price isn’t necessarily what the value of the home is.

This is the number on the contract, the number you’ve agreed to buy the property for. And this number is foundational to whether or not your project will turn a profit.

3. Scope of Work – How Do You Fix Up a Real Estate Investment?

Many beginner investors mistake “scope of work” for the budget. Scope of work is what you’re going to do to the property, not the number of what that work will cost.

Will you add a bedroom? Re-do the garage? Are you going to convert the porch to additional square footage? Or add egress windows to the basement?

Scope of work is your rehab plan. Lenders need this info to find out what kinds of properties they should compare to yours to estimate an after repair value.

4. Budget – What Is a Real Estate Budget?

During the conversation with your lender, have a high overview of your construction budget. You don’t necessarily need all the details ironed out quite yet.

For example, you can estimate that the kitchen will cost $10,000, siding $6,000, windows $4,000, and new paint $2,000. At this point, you don’t need to share a breakdown of the cost of each new appliance, labor and materials, etc.

You just need a realistic estimate of how much it will cost to get into the property. Having your scope of work lined out helps you with an estimated budget. When you know the purchase price an your budget, then you know how much the entire project will cost.

5. Estimated Profit (Flips) / Estimated Equity (Rentals) – How Much Will a Deal Make?

Estimated profit is what you expect to make on the transaction, between buying the property, fixing it up, and selling it again.

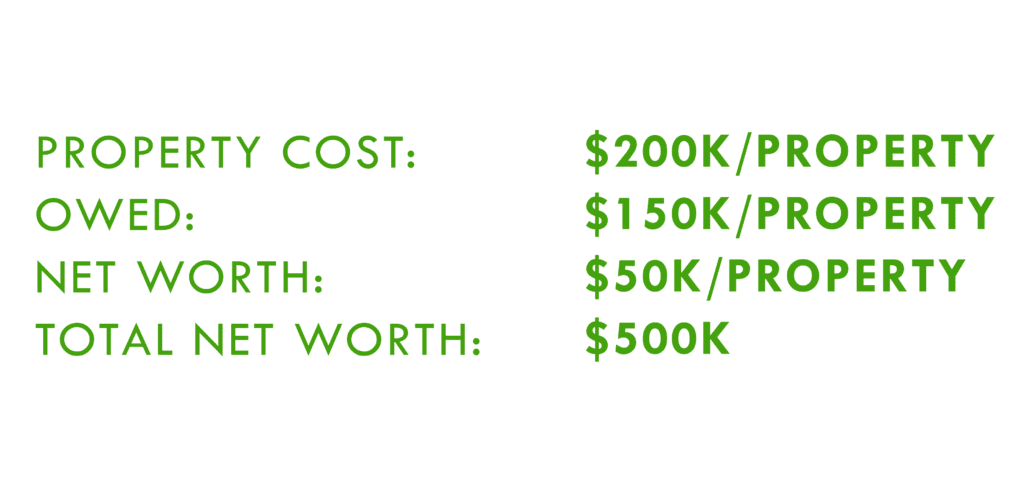

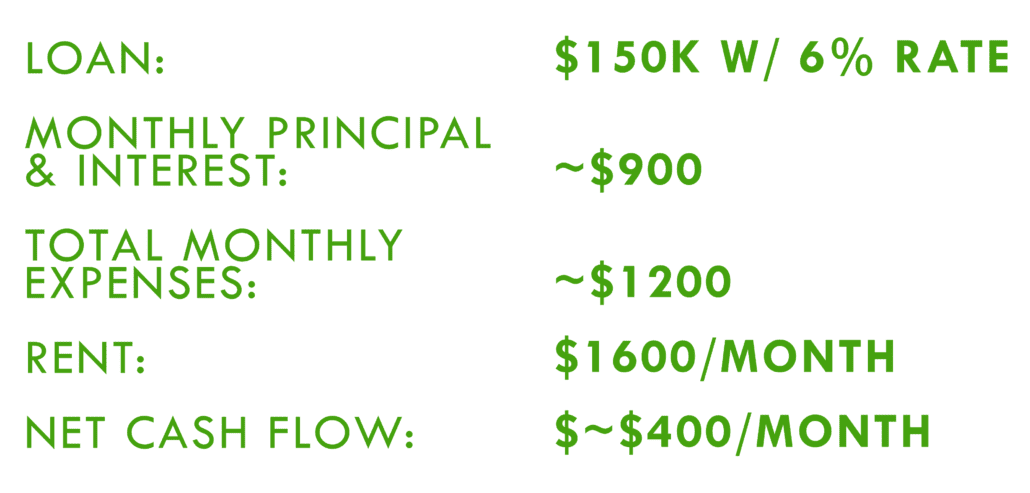

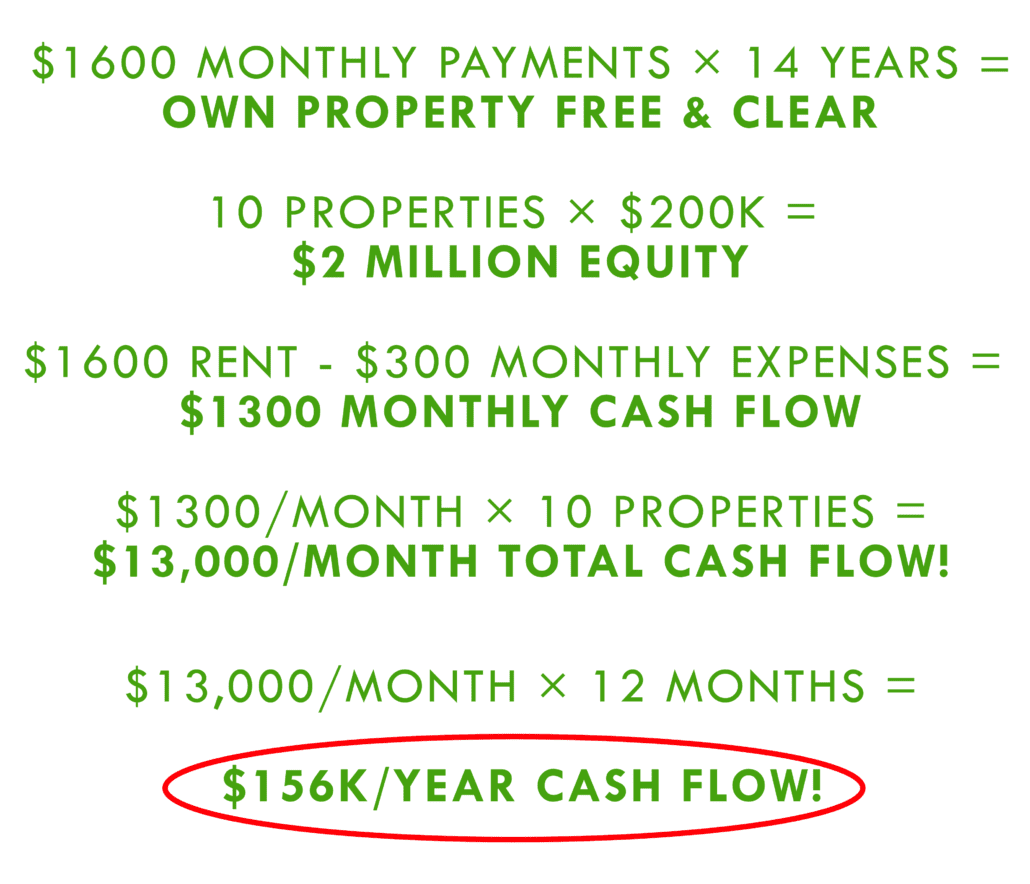

Equity is the difference between the amount you owe and what the property is worth. You build equity on your rentals by successfully refinancing after a flip and paying down the mortgage with rent income.

The number one reason to be in real estate investment is to make money and create wealth – it’s true for lenders, and it’s true for you. So, it’s important to both you and your lender that your properties make profit or build equity.

You’ll need your estimated profit / equity when you bring a deal to your lender.

6. Comps / ARV – What Does ARV Mean in Real Estate Investing?

ARV is the after repair value. It’s what the property will appraise for, or sell for, on the current market once the scope of work is completed.

You estimate a property’s ARV by looking at the prices of similar homes in the current market.

Comps (comparables) are those similar homes you look at. It’s important that your comps have the same value as your property.

For example, if your deal is for a 950 square-foot home, you’ll compare it to other 900 to 1,000 square-foot homes on the market, not a 2,000 square-foot one. A 2-bedroom, 1-bath house will be compared to houses of the same specifications, and not compared with 4-bedroom, 2-bath homes.

For your ARV to be accurate, you need to stay true to your scope of work. If you only repaint and re-carpet a house that needed much more work, you won’t get top-of-the-market value when you try to sell or refinance.

On the other hand, if your scope of work is a full remodel, your comparables should be homes that are fully remodeled, so you don’t miss out on any profit.

The money you put into fixing up a house isn’t a direct indicator of how much the house will be worth. What the property looks like when it’s finished has nothing to do with how much it cost to get it there.

To find the true profitability of a deal, your ARV and comparables help:

ARV – (Purchase Price + Budget) = Profit Amount

7. Exit Strategy – How Will You Pay Your Real Estate Loans?

When a lender asks for your exit strategy, they want to know your plan for paying off the loan. For hard money loans, your exit should be fast.

If it’s a flip, your exit strategy is to sell the property, then pay off the loan.

If it’s a rental, your exit strategy is to refinance into a long-term loan, which will pay off the hard money loan.

The Why Behind Money Wise – Real Estate Investing Definitions

When you come to the table prepared, with strategies, numbers, and knowledge, you can speak the same language as your lender.

This is key to ensuring you have a safe transaction with a lender that is working in your best interest.

Curious About Other Real Estate Loan Fundamentals?

If you have any questions, or want coaching through a deal, we’re happy to help. Reach out at HardMoneyMike.com.

For more info on real estate loan fundamentals, keep up with our Hard Money 101 series on our blog, or visit our YouTube channel here.

Happy Investing.