What Does ARV Mean in Real Estate Investing?

To profit in real estate investing, you’ll need to know: What does ARV mean?

Real Estate Investing: What Does ARV Mean?

ARV is the after repair value. It’s what the property will appraise for, or sell for, on the current market once the scope of work is completed.

You estimate a property’s ARV by looking at the prices of similar homes in the current market.

What Are Comps?

Comps (comparables) are those similar homes you look at. It’s important that your comps have the same value as your property.

For example, if your deal is for a 950 square-foot home, you’ll compare it to other 900 to 1,000 square-foot homes on the market, not a 2,000 square-foot one. Similarly, compare a 2-bedroom, 1-bath house to houses of the same specifications – not to 4-bedroom, 2-bath homes.

How To Get an Accurate ARV

For your ARV to be accurate, you need to stay true to your scope of work. If you only repaint and re-carpet a house that needed much more work, you won’t get top-of-the-market value when you try to sell or refinance.

On the other hand, if your scope of work is a full remodel, your comparables should be homes that are fully remodeled, so you don’t miss out on any profit.

The money you put into fixing up a house isn’t a direct indicator of how much the house will be worth. What the property looks like when it’s finished has nothing to do with how much it cost to get it there.

What Does ARV Mean for Profit in Real Estate Investing?

Estimated profit is what you expect to make on the transaction between:

- buying the property

- fixing it up

- selling it again.

Additionally, equity is the difference between the amount you owe and what the property is worth. You build equity on your rentals by:

- buying properties with a low purchase price and a high ARV

- successfully refinancing after a flip

- paying down the mortgage with rent income.

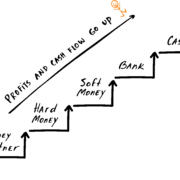

If you want to find the true profitability of a deal, then use your ARV and comparables:

ARV – (Purchase Price + Budget) = Profit Amount

Read the full article here.

Watch the video here:

https://youtu.be/4RErCDhSi44

Leave a Reply

Want to join the discussion?Feel free to contribute!