Hard Money Lender vs Bank Financing: Why You Need Both

Which funding should you get? 3 case studies on a hard money lender vs bank.

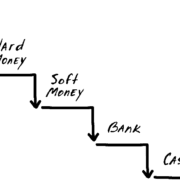

In the typical real estate career, you follow this funding path:

- You use hard money because it’s all you can qualify for.

- With experience, you start qualifying for bank loans, so you move on from hard money.

What most people miss is a crucial third step:

- Now you have two valuable funding sources in your toolkit.

Most people view hard money as a stepping stone to “better” financing. While true in some ways, putting hard money in the past can make you miss out on some amazing opportunities hard money offers.

Let’s get over 3 examples of clients we’ve had who are far into their real estate career but still benefit from hard money. And lastly, we’ll go over how you can make that big step into bank financing.

3 Case Studies – When to Use a Hard Money Lender Instead of a Bank

We work with people who have been doing the investing game for 10 to 15 years… who still utilize hard money whenever they need it. Here’s what three of those people do and how they use hard money vs bank loans.

Mary: Cross Collateralizing with a Hard Money Lender

Mary is a developer who builds big homes here in Denver – anywhere between $2-4 million.

She has bank financing set up for the majority of the construction period. However, when she finds a lot or house she wants to scrape, it usually needs to close within 7-10 days. Her bank funding can’t work that fast.

So, she comes to a hard money lender to get the property quickly and with 100% financing. She cross-collateralizes (aka, uses her other properties) to make sure she gets full funding with us.

Once the property is approved through zoning and everything, her bank funding kicks in to pay off the hard money loan.

Jeff: Hard Money Lender a Solution to a Bank Limit

Jeff is a flipper who does about 4 or 5 projects per year here in town. They’re pretty good sized, ranging from $400k to $800k.

But his bank sets a limit, and he’s only able to do about two flips at a time with them. So when he has two projects going but finds a great deal, he’ll go to a hard money lender. Hard money frees him up to jump on a good property, even when his financing is tied up elsewhere.

TC: Hard Money Lender Is Faster Than a Bank

TC has been a longtime client of ours who also uses other financing too. He came across a deal where he was one of five bidders. On the very first day, he bid $30,000 less than everyone else because that’s what would fit his budget with construction and everything.

And he won the deal. Why?

Because he could also close in less than 10 days with a hard money loan. He didn’t need an appraisal, inspection, or anything else that prolongs the sale and gives sellers a headache.

Using a hard money lender instead of a bank was the only way he was able to get that property for 10% less.

You Need Both!

It’s not either hard money or bank loans. You need to use both.

At the end of the day, bank loans are almost guaranteed to be cheaper with interest rate and points. They should always be used when possible. But sometimes bank loans aren’t realistic – you need money now, or you lose out on a great deal.

Banks:

- Cheaper, lower interest rates and fees

- You get the entire loan upfront

- Require a good credit score

- Take longer upfront (closings can take 2-6 weeks or more)

- Necessary for long projects

Hard money lenders:

- More expensive, higher interest rates and points

- Can take longer in the middle of the project to get funds from escrow

- Lenient on credit

- Fast closings (sometimes within days)

- Flexibility

- Great for short-term projects

Hard money lender vs bank? They both need to be valid funding options in your career.

How to Get Bank Loans for Real Estate Investing

It may be important to keep hard money in your back pocket, but you should always be moving toward acquiring bank loans. This cheap, long-term funding will fuel the majority of your career.

Here are the steps you need to take to make the leap from hard money to bank funding.

1. Be In Business for 2 Years

You need at least one of the following for bank loans:

- A W-2 job that meets the income requirements (aka, investing is a side gig for you and you make plenty of money elsewhere).

- Your business has been established for 2 years or longer.

If real estate investing is your full-time job, then you need to show that you have experience and income from it. In that 2-year span, you will want to complete at least 3 successful projects.

2. Have a Good Credit Score

Bank loans are highly credit score-driven. You’ll need a score of at least 680, but higher if you want better terms. This is something you should be working on now so it’s ready when you really need it.

If you struggle with your score because of credit usage from your business, check out this article for a solution.

3. Down Payment Funds

This can be a major obstacle for newer investors. Luckily, you have a lot of options for help with the (usually 20%) down payment for bank loans:

- Get a HELOC

- Find unsecured lines of credit

- Use real OPM

- Money saved from other flips

Find Investor-Friendly Banks

One last tip on the journey from hard money to bank loans: find the banks that like to work with real estate investors.

Most of the large banks, like Chase and Wells Fargo, will only work with a very, very select few investors. Instead, you should look at local banks and credit unions that offer investor loans.

Don’t bother barking up the wrong tree. Find a lender who wants to help real estate investors. As you move through your career and get your experience, start reaching out to find the banks in your area that love to work with investors.

Need a Hard Money Lender vs a Bank?

Need a quick close, gap loan, bridge loan, or a fix and flip loan? Reach out at Info@HardMoneyMike.com.

We can help you find unique funding that’s outside of the banking box.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!