Is Hard Money a Trap? How to Set Yourself Up for Success

Have you heard that hard money loans are a trap? Here’s what you should do so it doesn’t happen to you.

It’s a big misconception: hard money is a trap.

A lot of investors think if they enter a hard money loan, they’ll never escape. Hard money gets a reputation as a death sentence for your profits.

And like all loans, credit, and other money-borrowing options, if you use it wrong… it does feel like a trap!

We want you to understand what behaviors make hard money loans unprofitable. And more importantly – how to use hard money to your advantage in your real estate investments.

Hard Money Is a Temporary Solution

Here’s where hard money naysayers go wrong: hard money loans should only be a temporary solution. They are not meant to be long-term options for investors.

If you enter a hard money loan with a long-term mindset, then you’ve already fallen into the “trap.” When you treat it like a long-term loan, you’re likely to lose a lot of your profits paying it back.

Hard money is short-term. To make the most of your loan, you have to get in and out of it fast. Here are 3 vital tips to make sure that happens.

-

Go Into the Loan with a Plan to Exit

Never walk into a hard money loan with no plan to get out. This plan will look different depending on your end-goal for your property.

If you’re doing a fix-and-flip, make sure to have the bulk of your construction work scheduled before setting up the hard money loan. You’ll need to get the work done and sell as soon as possible before the loan begins to eat into your profits.

If you’re fixing and holding (renting), make sure to line up a long-term loan alongside your hard money loan. Start the refinance process before you’ve completed the rehab of your property. The longer you have to wait for refinancing, the longer it takes to pay back your hard money loan (and the less profit you’ll get from your work).

The wrong lender might take advantage of your lack of knowledge and preparation. But if you work with the right lender, like Hard Money Mike, you’ll get personalized help to make a plan, set up the right long-term loan, and get out with your profit.

-

Focus on Your Credit Score

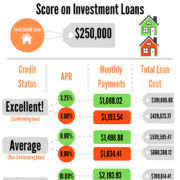

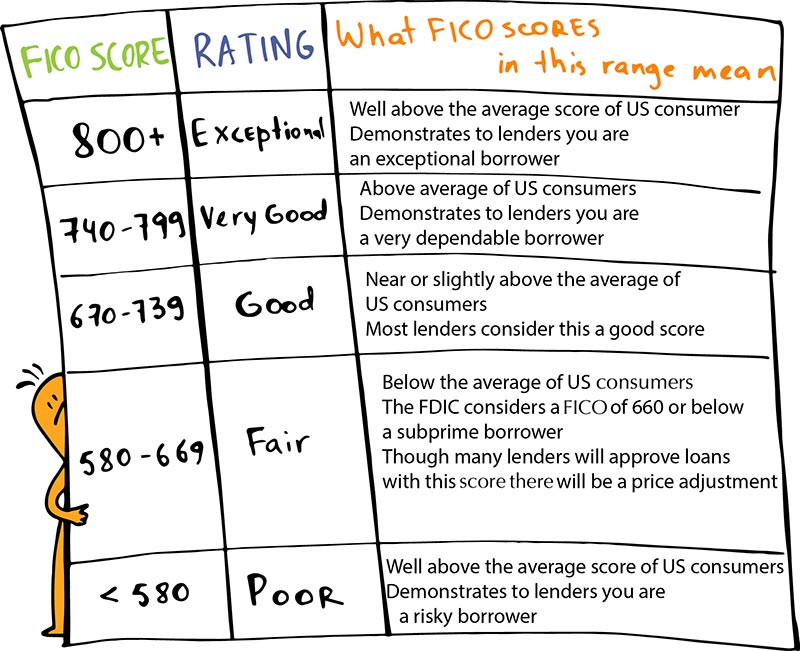

It’s important to get a good refinance loan to help you pay off your hard-money loan when the project is over. To make sure you’ll get that good loan set up on time, you’ll need to have a good credit score.

With a score above 670, you’ll have an easier time getting a good loan from a financial institution. If your credit score is below 640, don’t even take out a hard money loan until you raise your score. No lenders can help you refinance with a score that low.

If you need tips on raising your score quickly, check out this post.

-

Don’t Delay Construction

This is where many investors go wrong.

They close the deal with a hard money loan. Then they… don’t start work. Or, they start, but hit road bumps they didn’t predict that cause major delays.

Plan the rehab of your project beforehand. Get your equipment, permits, and contractors in place as soon as possible. Have everything scheduled. Look for problem areas in advance.

The faster the work is done, the faster you can sell or rent. Which means the faster you can get out of your hard money loan, and the more money you make from your investment.

Want More Guidance for Your Hard Money Loans?

Hard money is a valuable tool for prepared real estate investors who use it appropriately as a short-term solution.

Let Hard Money Mike give you guidance to get in and get out of your investments quickly and profitably. We’re excited to set you on a path that makes you the kind of money you need to live the life you want.

Need to see if you’re paying too much for hard money? Download our HMM Loan Optimizer to quickly find the best hard money option for your project.

You can also check out these videos about hard money on our Youtube channel.

Happy investing.