Understanding Real Estate Loans: What Is a DSCR Loan?

What is a DSCR loan, and when should you use one?

DSCR loans have been around for a few years, and they’re only getting more popular.

These are unique opportunities for funding rental properties. But they aren’t for just any deal.

Are DSCR loans right for you? Could you find properties that qualify? Let’s find out.

What is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio, which is a term used in the mortgage industry.

In the real estate industry, a DSCR loan is more commonly known as an “easy loan.”

What is it that makes a DSCR loan so “easy”?

DSCR Loans’ Easy Reputation

DSCR loans are easy because they cut out 50 to 60% of the paperwork required for a typical loan of its kind. If you’ve ever done a loan for a rental property, you know the paperwork seems endless.

All a DSCR loan looks at is whether your property’s rent covers your monthly expenses. At the very least, your rent (income) needs to be higher than your expenses – payments, taxes, insurance, HOA, etc.

The only other consistent criteria for getting a DSCR loan is your credit score. But if you have a good to great credit score and a cash-flowing property, you can get one of these easy DSCR loans.

What Is Unique About a DSCR Loan?

Every DSCR loan will be slightly different. You can find a DSCR loan in any shape or size.

Each lender puts their own nuance in their DSCR loans. There’s no national standard for underwriting for these loans. There are thousands of institutions offering these loans, so there are thousands of different versions of them.

For your investments, you can find DSCR 30-year loans, 3 to 7-year adjustables, interest-only loans, and more. DSCRs are useful for their range of options.

But you do have to shop around for each of your DSCR loans. Each lender will have different criteria, and your different rental properties will each meet a different set of criteria.

Take your time finding DSCR loans, and take advantage of their wide variety.

Other Common Requirements for DSCR Loans

As mentioned, DSCR loans can vary widely from lender to lender. But there are a few more common requirements for DSCR loans to keep in mind.

First, DSCR loans typically require 20% down for a purchase. Their refinance max is usually 75%. There are unique lenders out there that will offer more, but a lower down payment will be offset by higher interest rates.

Second, interest rates for DSCR loans are typically around 1.25 to 1.5% higher than other traditional conforming conventional loans.

Third – and this is an important one – DSCR loans almost always come with pre-pay penalties.

You have to keep the loan for a set amount of time, usually 3-5 years. Or else you have to pay the lender a penalty for paying it off early. That means if you sell or refinance, they’ll charge you a penalty.

Lenders will want these loans to stay on the property for a longer amount of time. So they penalize you for ending the loan before their minimum timeframe. Watch for these penalties, and be sure they fit into your guidelines for a project.

DSCR Loan Pros and Cons

Every loan in the world has its pros and cons. The important thing is to be able to evaluate whether it’s right for your property.

DSCR Loan Pros

No Income Requirements

The biggest advantage to a DSCR Loan is that there are no income requirements.

You don’t have to work a W2 job, or be self-employed for 2 years. The application won’t ask where you work or what you do.

This is helpful if you’ve just started a new job, become recently unemployed, or have more unconventional income.

The number one requirement for a DSCR loan is the income from the property itself.

Business-Friendly Financing

DSCRs are considered business loans since the properties are non-owner-occupied. The majority of them allow you to finance in an LLC or other business name.

They also do loans in different states. If you have properties in Colorado and Florida, you can go to one lender and they can lend both places.

Minimal Paperwork

If you’ve ever done a traditional loan, you know the paperwork is a giant hassle. DSCR loans have very minimal paperwork. They’ll need to look at your:

- Credit score

- Loan-to-value

- Rent

And that’s it.

The majority of lenders won’t ask for info on your other properties. They just want to know the other properties are current, and that shows up on your credit report. Even if you have other rental properties with negative cash flow, it won’t impact your ability to get a DSCR loan on a positive cash-flowing one.

As long as you have a property that’s making money, you can get this loan for very little paperwork.

DSCR Loan Cons

Prepayment Penalties

DSCR loans almost always come with pre-pay penalties. You have to keep the loan for a minimum timeframe of around 3-5 years to avoid a fee for paying off early.

So, if you get a DSCR loan, then a year later you find someone who wants to buy, or some other unexpected event comes up and you have to sell the property… You’re stuck paying to get out.

And prepayment penalties can be up to 5% of the loan amount.

Let’s say you have a $200,000 loan with a 5 year pre-pay minimum. And you end up wanting to sell it after 2 years. Then you’ll have to pay the lender 5% of $200,000 – or $10,000 – just to get out of the loan.

Higher Rates Than Other Conventional Loans

Some DSCR loans have 5, 7, or 10-year ARMs that keep rates down. Still, DSCR interest rates will be 1.25 to 1.5 points higher than other conventional loans.

This will impact your cash flow, so a property has to have a strong cash flow for you to consider a DSCR loan.

Pros vs Cons: Are DSCR Loans Worth It?

Despite their drawbacks, DSCR loans can be a truly great option.

It’s a great portfolio loan for real estate investors. DSCR is perfect for people who want something easy, or who don’t have the income traditional loans need.

As long as your specific property fits the criteria and the cash flow is there, a DSCR is a great easy loan to build your portfolio without the hassle of underwriting.

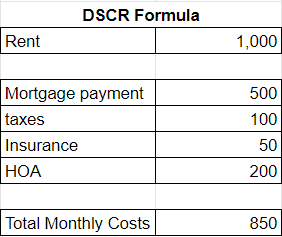

DSCR Formula

An important part of considering a DSCR loan is understanding the DSCR calculation. All lenders will look at this formula for DSCR loans.

Let’s go through and look at the numbers to find out if your property has enough cash flow for a DSCR loan.

(You can grab our free download that sets up this DSCR formula at this link.)

Income & Expenses

The number one thing DSCR lenders look at is income.

For this example, let’s say our rent is $1,000 per month.

The next thing they look at is expenses.

They want to make sure your income more than covers your total costs. They’ll look at: mortgage payments, taxes, insurance, and HOA. Right now, they don’t look at property management costs, but that could change in the future.

Let’s fill out these numbers for our example property:

So, the total expenses for this property are $850. Right away, we can see that income more than covers expenses, and this property cash flows $150/month.

Applying the DSCR Formula

Then, the equation lenders will do to determine this cash flow will be:

Income ÷ Expenses = Cash Flow Rate

Or, in this case:

1000 ÷ 850 = 1.17+

Lenders are looking for a positive cash flow. They want properties with:

- Bare minimum: One-to-one. This means your rent at least covers your costs. (Example: Rent is $1000 and your monthly expenses on the property is $1000).

- Better: 1+

- Best: 1.25+

Download our free spreadsheet to fill out this formula for your properties to see if they’d qualify for a DSCR loan.

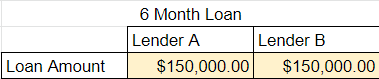

DSCR Loan Down Payment

What is the down payment requirement for DSCR loans? What does refinancing look like with this type of loan?

Down Payments for Different Types of Properties

Your typical DSCR loan will require 20% down, but as interest rates are rising, you may see that that tighten up to 25%. So, if you’re buying a $100,000 property, they’ll loan you 80%, or $80,000. But you’ll have to come up with the remaining $20,000.

If you go from a single-family to a four-plex (some DSCR loans work for up to six-plexes!), you may be required to put in more like 25-30%. As your “doors” go up, so does your down payment.

But always check around! DSCR loans are the wild west. You’ll have lots of choices, every lender likes having slightly different requirements.

Refinancing with a DSCR Loan

For a rate and term refinance, a DSCR loan will typically cover 75%.

So you’ll need 25% equity in the property on a DSCR loan to do rate and term.

Cash out refinancing is a little tighter. Most are at 70%, but you could find outliers between 65 and 80% (but the higher ones will raise your interest 2 or 3 points).

For true, good DSCR loans, you’ll be maxed out at 75% for rate and term, 70% for cash out.

Let’s say you’re looking at a property that’s worth $100,000. On the cash out, you can only get $70,000, and you’ll need $30,000 in equity. For rate and term, the max loaned is $75,000.

At the end of the day, it’s impossible to give a one-size-fits-all answer about DSCR loan amounts. There are so many options, and your properties will each require different loans. You’ll have to talk to brokers and lenders in your area to find the best rates for you.

Using DSCR with BRRRR

If you’re lucky, the rental property you’re getting into is a BRRRR property. You can use a DSCR loan like any other traditional conventional loan to refinance.

If you buy the property at 75% or below its ARV, you can use a DSCR loan and buy a rental property with zero money down.

Airbnb Investing with a DSCR Loan

Can you buy an Airbnb with a DSCR loan?

Short answer: yes. However, you may come across a few obstacles.

Using Standard Rental Rates

Typically, to refinance an Airbnb, a lender requires 2 years’ history of rents and expenses for the property.

If you can’t provide that, a DSCR loan could be an option for your short-term rental.

But to get the DSCR loan, you need to use the standard rental rates for a standard rental property in that area. Without a longer history, you can’t use your Airbnb rates as the income for the property.

This can be a major hurdle.

A property that’s successful with short-term rentals (Airbnb, VRBO, etc.), probably makes more money than a standard monthly rental in the same area. In fact, the monthly income from an Airbnb can be 3-4x the standard rents in an area.

But a DSCR will require you to use the number for standard rents. So it’s possible that even though your short-term rental is cash-flowing, it might not qualify for a DSCR loan.

Lenders and Airbnb Investing

DSCR loans vary from lender to lender. Three-quarters of DSCR lenders will be open to loaning for Airbnb properties. The other quarter will want nothing to do with it.

Some lenders look at Airbnb as a riskier investment. Cash-flow has the potential to be higher, but there are a lot of moving parts. Also, some municipalities put restrictions on short-term rentals, making them a more unpredictable investment in lenders’ eyes.

It’s still worthwhile to research a DSCR loan for your Airbnb. You should always shop around – you’re bound to find the right lender with the right loan for your project.

What Other Loans Are Available to You?

DSCR loans are unique, great opportunities for some rental properties. If you have more questions about DSCR, don’t hesitate to reach out at HardMoneyMike.com.

Again, here’s the link to download our free DSCR loan calculator.

And if you’re curious about your other loan options as a real estate investor, try this free lending options download.

Happy Investing.