How Good Debt Can Make Real Estate Investors Rich

How Good Debt Can Make Real Estate Investors Rich

How can good debt make investors rich? As real estate investors, it is important to differentiate between good debt and bad debt. You do need debt to create income, which in turn creates wealth. That is what real estate investing is all about! Learning how you can create wealth using other people’s money, also referred to as OPM. You don’t have to be rich, have a college degree, or a PHD to succeed in this business. All you need to understand is how using other people’s money can create wealth and income. Today we will run through the numbers to give a clear picture of what to expect when purchasing a property and how you can get rich off your investment.

Investors who Fix and Flip

If you’re a flipper and making $50K to $200K a year or more, then it’s very likely and very doable that you will create wealth. All you have to understand is what is good debt and what is bad debt. Good debt is debt that is going to create income and wealth. Real estate investing is all about using leverage, or other people’s money. It may take a little bit of your money, if any, to get started on this venture. In the end it’s all about finding really good properties, undervalued properties, and properties that people no longer want. By purchasing them correctly and using the right debt, you will in turn create income and wealth very quickly.

Wealth and Income Example for Fix and Flip Investors

Let’s take a look at a normal purchasing situation for a fix and flip investor. This is someone who is doing 4 to 5 properties a year. Yes, you can get into 4 to 5 properties very easily if you are focused and understand your cash flow. In order to accomplish this, you need to use other people’s money for the majority of the expenses, if not all of them, depending on the deal. Keep in mind that a good deal is something that is under 70% all in.

ARV: Is the estimated value of the property after repairs have been completed.

Profit: An average of what you want to make of the sales price. Normally a range between 10% and 15%

ARV = $300,000

Profit at 12% = $36,000

4 flips a year = $144,000

5 flips a year = $180,000

Numbers break down:

ARV = $300,000 at 75% means that you are all in at $225,000

All in total $225,000 broken down:

Purchase price = $175,000

Rehab budget = $50,000

National lenders:

10% of purchase price = $17,500

They cover 100% of rehab = ($50,000)

After closing costs and interest you are into this for roughly $25,000 to $30,000 for each property

Now where else can you put in $20,000 to $30,000 and come up with $36,000 in a matter of months? That is money that you are bringing into your life just by using other people’s money, using debt, and doing it correctly.

How do these numbers compare to other types of investments?

The majority of investors are only investing in stocks and bonds. If they get 8% then they are happy with their investment. However, if they put in $30,000, then they may only get a $2,400 profit for the year. Compared to the $36,000 that you created in a matter of 4 to 5 months, their profit is just a drop in the bucket.

Wealth and Income Example for Rental Properties

Maybe you want to invest in rental properties also. There is a process out there called BRRRR, which stands for Buy, Rehab, Rent, Refinance, Repeat. These rentals are properties that you intend on keeping in your rental portfolio long term. They can not only create wealth, but will build equity and acquire a monthly income. You can get started by finding a property from a wholesaler or real estate agent that is a good deal. It may need some work, but real estate investing is all about finding undervalued properties and turning them into profitable investments.

Numbers break down:

ARV = $200,000 at 70% means that you are all in at $140,000

All in total $140,000 Purchase price and Rehab budget (normally less for rentals)

Refinance break down:

Refinance at 75% of $200,000 ARV = $150,000 (what you owe)

Equity created = $50,000 net worth

There are some closing costs for both loans

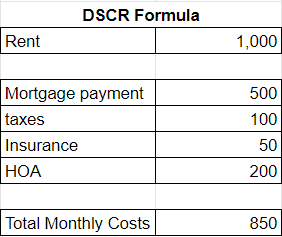

It’s all about getting into the right debt on the right properties. From purchasing the property to fixing it up, all of these expenses can be paid using other people’s money, a hard money lender, or even a private lender. Now it is time to use another form of debt. This is long term debt, such as a traditional loan, DSCR, or whatever loan is going to work best for your needs. If this is done correctly, you can then refinance everything including closing costs and payments, up to 75% or even 80% depending on the products that you use.

In conclusion

All you need to get rich is a clear understanding of how using other people’s money can create wealth and income. Nowadays, we see more credit card debt and bad debt that is greatly impacting people’s ability to get rich. As real estate investors, we need to turn to more asset based debt, in order to create the lifestyle, income, and wealth that we want.

Watch our most recent video to find out more about how good debt can make real estate investors rich.

If you have a good deal at 70% or below the ARV, you can reach out to us! We would be happy to talk to you about your investments, provide a fix and flip loan, and help you find OPM.