What’s Your 2-Year Plan?

Close your eyes. Clear your mind. Take a deep breath.

Now, let’s pretend we’re talking to each other two years from now. What happened during that time period that made you proud and put a smile on your face? How does your cash flow look? What kind of work schedule do you have? How does life look for you and your family?

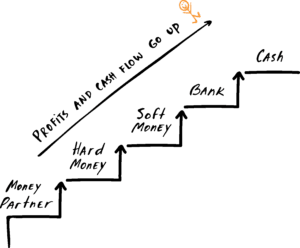

When it comes to investing, we have discovered that thinking ahead two years leads to the most success. Why two years? Well, it’s short enough to imagine without being overwhelming, and it’s long enough to create tangible, positive change in your life.

Coming up with a plan is as easy as one, two, three:

Step 1: Imagine where you want to be in two years.

Step 2: Evaluate where you’re starting at today.

Step 3: Create a plan that connects your current reality to your future dreams.

How do you formulate an actual plan? Well, that’s what our team is here to help you do. It’s just a matter of picking up the phone and giving us a call to chat.

One conversation can change your future…and your life!