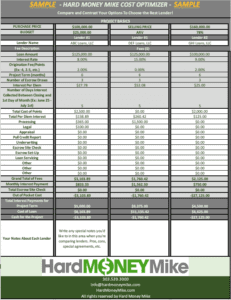

Introducing the Hard Money Mike Loan Cost Optimizer!

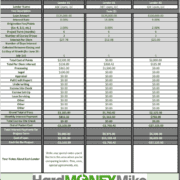

With the Loan Cost Optimizer, our goal is to help you make more money every time you complete a fix and flip or fix and hold. This software will help you discover the real cost of various finance options.

The key benefits you can expect from using the HMM Loan Cost Optimizer include:

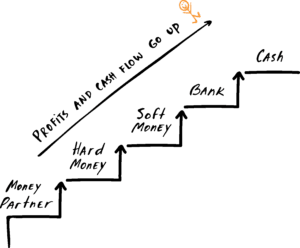

- Seeing how much money you’ll need to contribute to the project and how it will impact your profits and cashflow.

- Comparing all lenders (and their hidden fees) and EASILY calculating the TRUE cost of your loan.

- Evaluating your terms and deciding which is better: paying higher points or a higher rate.

- How the length of your project will impact the cost of each loan option.

Since the Loan Cost Optimizer is a newer product, we’d love to hear your feedback on how we can make it as user-friendly as possible!

Our goal is to help real estate investors like you succeed, so feel free to share this vital tool with your network.

Ready to make more money on your next deal? Then request our HMM Loan Cost Optimizer and start comparing your options today! For a limited time, we’re offering this tool for free, so email Info@HardMoneyMike.com for your copy or download your copy here.