How Will Changing BRRRR Loan Requirements Affect You?

Lenders are upping the requirements for a BRRRR loan. Here’s what to know to prepare.

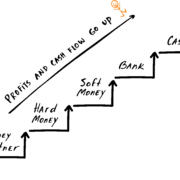

BRRRR has two loans – hard money to buy, long-term to refinance. With inflation, both loans will have lower LTVs.

What else should you expect?

Hard Money BRRRR Loan Requirements

Many private money companies – particularly bigger, national lenders – are requiring 20% down.

Hard Money Mike is a little different. We fund using real private money, so our loans aren’t as dictated by federal rates. We still go up to 100% on financing, as long as you’re approved for your long-term loan up-front.

Smaller lenders can give you a better advantage with BRRRR during inflation. But you should still expect many private lenders to offer lower LTVs.

Bank BRRRR Loans with Inflation

Long-term loans are decreasing, making it harder to cash out. Traditional lenders could go down to 70% or 65% LTVs, or just have tougher requirements.

Money is shrinking, so the pot of money available to you on either BRRRR loan is shrinking.

The Plus Side of BRRRR and Inflation

What’s the good in all of this? If you’re in a bad financial position, you’ll have a hard time continuing your real estate career in inflationary times.

But, if you’re in a good position, you’ll be able to find fantastic properties in your pricepoint. And you’ll be able to find them for 20-40% less money than you could a year ago.

Don’t fight what’s happening with the economy – figure out how to use it.

Understand BRRRR loan requirements now. If you get into a BRRRR, fix it fast and refinance fast. Figure out your BRRRR’s long-term loan first before you look for a short-term loan.

Things are changing rapidly in the real estate investment world. Get yourself in the best position to be able to work with it.

Read the full article here.

Watch the video here:

Leave a Reply

Want to join the discussion?Feel free to contribute!