Hard Money Loans – Know the Basics

As a beginner investor, you need to know the basics about hard money loans.

The two most basic hard money answers you need are:

- What’s the difference between loan-to-value and ARV?

- How do you calculate them?

Know the Basics: Loan-to-Value

Firstly, what’s Loan-to-Value? Loan-to-value, or LTV, involves the:

- appraised value of a property

- as it sits right now

- with nothing changed about it.

As a real estate investor, if a property costs $100,000 as it sits, you know you’re going to put work into it and make it worth more. But that as-is value, the $100,000, is what lenders base their loan amount on.

Know the Basics: After Repair Value

Secondly is After Repair Value. After repair value (ARV) is used more by hard money lenders and the real estate investment world. Banks and traditional lenders more often use LTV.

Because in real estate investing, we’re basing our numbers on what you can do to the property. What can the value be once you fix it up? That’s the number that determines profit, so that number is more important for hard money lenders.

ARV is the target value of what the house will be worth after all your renovations. This ARV should always be higher than the current price of the house when you buy it.

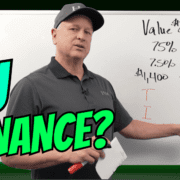

Calculating ARV and LTV for Hard Money Loans

Let’s say you found an undermarket property that’s selling for $100,000. If a lender says, “We’ll loan you 75%,” that could mean two things, and you’ll want to know the difference.

First, if they’re a bank, they’re likely talking about 75% of the value. In this example, that would be:

$100,000 × 75% = $75,000 loan

Hard money lenders will care more about the value of the home after repairs, so they go off ARV. If they loan you 75%, that would be:

$150,000 × 75% = $112,500 loan

If a loan is based on ARV, lenders might want to know – what are you doing to the property? Different renovations will affect the value of the property in different ways. What you will do and the quality of your work will affect the ARV.

When you know the basics about LTV and ARV, your hard money loans will be much smoother.

Read the full article here.

Watch the video here:

Leave a Reply

Want to join the discussion?Feel free to contribute!