How to Qualify for a DSCR Loan in 3 Steps

3 quick tips from a lender on how to qualify for a DSCR loan.

In the real estate investing biz, you need to become fast friends with the DSCR loan.

DSCR loans are great for getting out of hard money on fix-and-flips you end up wanting to keep. They’re also a great alternative to traditional loans for any rental property.

While traditional loans have universal (and often strict) underwriting guidelines, DSCR loans are a little more individualistic. Each lender is their own gatekeeper to their DSCR loans

Even though qualifications vary from lender to lender, we want to share with you 3 steps that will always move you toward a DSCR loan approval. Here’s how to qualify for a DSCR loan in 3 steps.

1. Credit Score: Understanding Your Credit

Your credit is the main factor that lenders consider when evaluating your loan application.

Many lenders (especially in the current tightened lending environment) will zero in on your credit score. But all lenders will at least check your report to look for foreclosures, bankruptcies, and your history in general.

Often, though, a higher credit score can get you a better loan-to-value (LTV) ratio and a lower interest rate. For example, a 740 score will get you an LTV 5-10% more than a 640 score. Your interest rate with a 740 score will be .5-2% lower than the interest rate with a 640 score.

If your credit score is below 700, you should take steps to improve it – such as paying down credit card debt and making sure all your payments are on time.

This article offers some ideas for raising your credit score quickly. You can also download this free credit score checklist to get you where you need to be.

2. Money: Down Payments, Closing Costs, and Reserves

In addition to the down payment, you’ll need to have enough money for closing costs and reserves.

Down payment will be 20-30%, depending on your credit. It’s also important for you to know how much equity the house will have, as this will predict some of your loan terms.

For reserves on a DSCR loan, lenders often require you to have 3-6 months’ worth of mortgage payments. This extra cash protects the lender in case your tenant unexpectedly vacates or some other unexpected situation arises.

The money doesn’t necessarily have to be yours – you can borrow OPM from a business partner, friend, or family member. To get a DSCR loan, though, your lender will want to see the funds for a down payment and reserves to approve you.

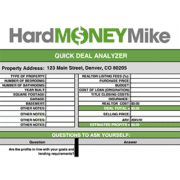

3. Know Your Numbers: Property Income and Expenses

DSCR loans are based on the property’s ability to generate income and pay for itself. So your in-flow and out-flow numbers are a major factor in whether or not you get a DSCR loan.

The minimum requirement is that the rent covers all expenses.

Expenses include:

- The mortgage payment

- Taxes

- Insurance

- Any HOA fees

Expenses not considered by your lender include:

- Property management fees

- Utilities

- Maintenance

If the property generates more income than expenses, you’ll get a better rate. However, if it doesn’t break even, you’ll likely end up paying a higher rate.

For example, if you show a lender your property can bring in $1,250 and your payments are only $1,000, you can get a better rate.

Know your numbers to get your DSCR loan approved. The last thing you want is a bad surprise when the lender tells you the numbers won’t work out like you thought.

How to Qualify for the Right DSCR Loan

These 3 steps are how you can qualify for a DSCR loan for investors.

Remember to focus on:

- Improving your credit score

- Having money for down payments and reserves

- Knowing your numbers ahead of time

Leverage is king in real estate. With a little bit of effort, you can secure the financing you need to grow your real estate investment portfolio.

We want to get you the right loan for the right project. Show us a deal or ask us any questions at Info@HardMoneyMike.com.

Leave a Reply

Want to join the discussion?Feel free to contribute!