3 Problems That Cause BRRRR Confusion

3 Problems That Cause BRRRR Confusion

Today, let’s talk about three big problems that cause many investors to experience BRRRR confusion.

Have you been thinking about investing in real estate using the BRRRR method? But you’ve hit a roadblock?

Unfortunately, you’re not alone.

A lot of real estate investors, both new AND seasoned, have heard about BRRRR, but haven’t used it.

Because they’re confused.

They’re confused about how to buy, rehab, rent, refinance…or all of the above.

So, to help unravel and debunk some of your confusion, let’s address some of the biggest questions we hear from our own clients about the BRRRR method.

#1: Is BRRRR real?

Yes. BRRRR is real.

There’s a reason why our team created this video for you. We’ve helped many clients succeed using the BRRRR method. But, just like you, many of those clients started their journey confused. Because they didn’t understand the entire process either.

And what they did understand wasn’t always accurate or true. Because they were working with bankers, lenders, or realtors who fed them misinformation or were simply out of the BRRRR loop.

#2: “Can you really find properties that work for BRRRR?”

Again, yes. Absolutely.

Even in our current, competitive market, there are properties that work perfectly for the BRRRR method. The trick is to find the right area to invest in. That might mean leaving your own town, city, or even state to find properties that produce solid cash flow.

And, trust us, those areas exist.

You can start your search by talking to wholesalers, investor-friendly realtors, or even other investors to see where they’re buying properties.

Of course, searching for cash flowing properties requires some time, effort, and patience. But, if you think about it, all you’re doing is looking for one to four properties a year. Don’t you think it’s worth a little work to change your financial future? We think so.

#3: “How much money do I need to make BRRRR work?”

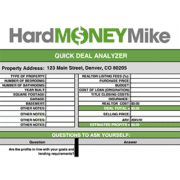

This is possibly the most crucial question we get. Not only is it a crucial question, but it also leads to the most confusion. Because it involves math, and most people don’t like math.

It also involves financing chit-chat, and again, a lot of investors don’t like talking about financing…even though the entire BRRRR process relies on good, solid numbers with good, solid loans.

But here’s the thing: once you grasp how to properly set up your BRRRR deal, then you can spend little to zero dollars on your properties.

Now, unfortunately, most investors don’t believe this, because, yet again, they’ve been fed misinformation by lenders, realtors, or other investors. So many people believe that have to bring a big down payment to closing.

And that’s because cash-out refinancing has been promoted as part of the BRRRR method. This isn’t a lucrative strategy. Not when there are other types of refinances that allow you to put little to no money in your deals.

The BRRRR method is an excellent real estate investment strategy. And, yes, it can be confusing when you get started. Because there’s a lot of chatter and misinformation flying around. Plus, nobody really likes math or financing. It’s true.

But if you’re willing to learn and do some work, then it’ll become easy. Very easy! And, better yet, lucrative. Because if done correctly, the BRRRR method can be repeated as many times as you want, as quickly as you want. Which means you’ll able to make the kind of money you want.

Happy investing!

Leave a Reply

Want to join the discussion?Feel free to contribute!