How to Get 100% Financing For Your Investment Property

How to Get 100% Financing For Your Investment Property

Many investors wonder how they can get 100% financing for their investment property. The answer is a cross lien. What exactly is a cross lien? A cross lien is when you use another property that you own, or one someone else that you know owns, and use it as collateral for the money that you’re looking to obtain. Today we are going to go over how you can get more money from your hard money lenders by using a cross lien.

How can a cross lien help?

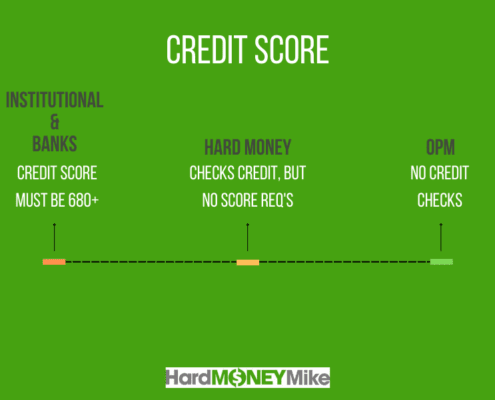

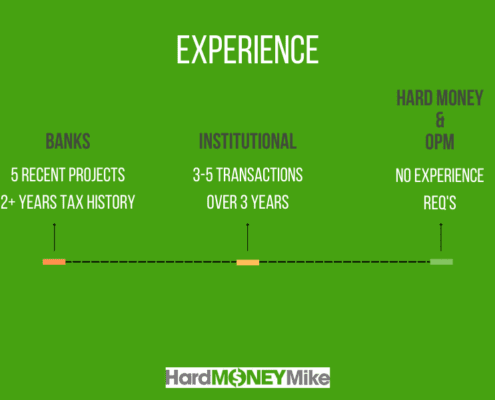

A cross lien can help you get more money for your projects and reach 100% financing. Even those with lower credit scores and little experience can use a cross lien to get the financing they need. Those with little experience experience struggle with LTV, as well as approval for Gap funding. A cross lien can also work for people who need more than 100% to purchase, rehab, or carry the property. Once the lender has the additional security or collateral, then they will be able to give you the money you need. To clarify, it doesn’t mean that you’re going to pay off the liens that are already on the property.

What properties are used for a cross lien?

Investment properties, land, commercial properties, and owner occupied properties are eligible for a cross lien. Anything that has equity in it can be used to create extra security for the lender. Just to clarify, equity is the difference between what you owe and what the property is worth. Typically you see 70% or less on equity. When looking at All in, meaning what you owe now and what you’re putting on the property. This needs to be at or below 80% CLTV. Just to clarify, CLTV stands for the combined loan to value that combines the 1st lien on the property plus the 2nd lien. There are exceptions, however, this is a general rule.

Let’s look at an example.

100% financing is needed for a fix and flip, however, the lender is only allowing 85% of the purchase. The borrower now needs to come up with 15%. Where do they get the extra money? The answer is a cross lien. The lender can use another property that the borrower owns in order to have the security they need to provide 100% financing. If you’re looking into using a hard money lender, then they are going to also look at your credit, as well as your experience, before approving funding. This may result in only 80% for the purchase and 100% of the rehab. In that case you will need 20% of your own money. Again, a cross lien can help to alleviate the pressure of having to come up with additional money and it can increase your cash flow if you are doing multiple projects.

What does a cross lien look like?

When using a cross lien for additional funding, the lender will come in and do a mortgage or deed on the property you are buying, as well as put a mortgage or deed on the other property. The other property is either a rental, piece of land, commercial, or even an owner occupied. By using two properties or more, you can get the money you want for financing.

When does the other property get released?

There are times when the property is released or the lien is taken off the 2nd before you pay off the 1st. Maybe that is because you have hit a milestone, or maybe the property that you bought is all fixed up and worth enough now to release the cross lien. Once the cross lien is paid off, then the property can be used to finance another investment.

In conclusion.

A cross lien is an excellent way to get 100% financing for your investment property. Maybe funding is a struggle because of your credit score or your experience isn’t there yet. Cross liens get something done, get something purchased, or get the financing you need to succeed. Remember the cross liens when you’re looking for finance options.

Here at Hard Money Mike we have a number of free downloads that can help you. Visit our website to find out more.

Would you like to find out more about How to Get 100% Financing For Your Investment Property? Watch our most recent video.