How to Use the Quick DSCR Loan Calculator

A DSCR loan calculator that shows the best loan to secure future cash flow.

There are two items you need to calculate DSCR: income and expenses.

Income is the rental income from the property. And for expenses, lenders only look at four costs: mortgage, taxes, insurance, and HOA. The debt service coverage ratio essentially compares the income to the expenses.

To make this calculation simple, we have a free DSCR calculator that you can use to find all this information.

Let’s go over an example of how to use this calculator to learn your DSCR and the best loan product for your property.

The Numbers You Need for a DSCR Calculator

The main numbers you’ll need to bring to the calculator to get an accurate DSCR are the property’s expenses and its income.

Mortgage

Firstly, we need to nail down the relevant expenses to input into our DSCR calculator. The first of these is the mortgage payment.

The two pieces of information you need to know are:

- What is the purchase price of the house?

- What LTV will you qualify for?

The calculator finds out the mortgage payment for you. Let’s say our property is $300,000. You may need or qualify for an LTV anywhere between 65-85%, but we’ll just go with the average of 75% for our example. Our loan, then, is $225,000.

Let’s say we qualify for a 7% interest rate. You’ll also input that number. Then the DSCR calculator will show the total monthly payments on three different products: interest-only, 30-year amortized, and 40-year amortized.

Taxes, Insurance, HOA

For these final three expenses, you might already have the hard numbers available for the property. Otherwise, you’ll have to make an educated guess based on your area.

For our example, we used:

- Property Taxes: $150

- Insurance: $100

- HOA (only applicable depending on your neighborhood): $150

Rent Income

Lastly: the property’s rental income. You may already have a tenant with a set rental rate. In that case, use that number. If you’re not currently charging rent, you’ll have to do some research on other housing in the neighborhood to see what you can realistically charge your future tenants.

In our example, we’ll say we get $1,700/month from this property.

The DSCR Loan Calculator’s Results

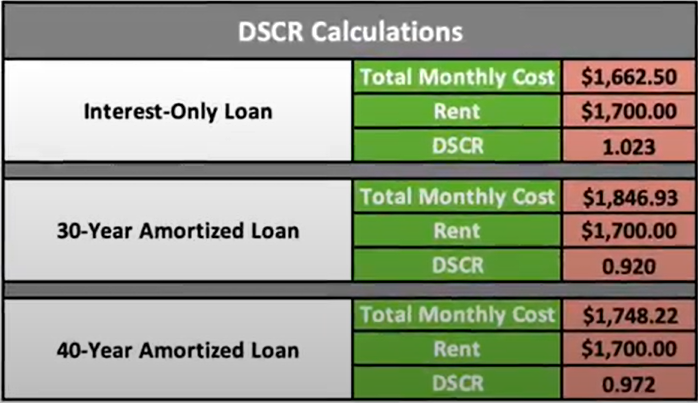

As shown below, the DSCR calculator shows you the costs, rents, and ratios of three possible DSCR products: an interest-only, 30-year AM, or 40-year AM.

This comparison gives you a look at different cash flows from different loan products. This can help you decide which loan you should apply for. You’ll have to consider both loan length and cash flow.

In our example, the interest-only loan is over 1, so that one will likely give us the best rate, best LTV, and highest cash flow.

The other two loan options are just under 1. There will still be some options on the market for DSCRs under 1, but you’ll have a higher interest rate.

Use a DSCR Loan Calculator for Your Property

If you need a DSCR loan for your property, you can find our DSCR calculator at this link.

Have more questions about DSCR? Interested in a loan? Send us an email at Info@HardMoneyMike.com.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!