How to Refinance a Rental Property Into a DSCR Loan

100% leverage for BRRRRs will be back on the table soon. Here’s how to refinance a rental property into a DSCR loan.

“Can I use a DSCR loan for a BRRRR?”

Yes!

A DSCR loan is one of the many products you can use to refinance your BRRRR rental property.

Using the BRRRR method, you could buy a house with a hard money loan, fix it up, then refinance with the DSCR.

Let’s go through an example of what it would look like to refinance a rental property into a DSCR loan.

What Is a BRRRR and a DSCR Loan?

To get started, let’s review what these two real estate investment terms are.

What Is a DSCR Loan?

A DSCR loan (which stands for debt coverage service ratio) is a long-term rental loan with minimal qualification requirements. Your ability to get a DSCR loan is based on the property’s debt ratio, not your income, history, or experience. As long as the rent from the property covers all its expenses (mortgage, taxes, insurance, and HOA fees), you can qualify for a DSCR loan.

DSCR loans rely on cash flow. There are some DSCR products out there designed for negative cash flow properties. But these loans have higher interest rates, lower loan-to-values, and more cash out-of-pocket.

What Is a BRRRR?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a time-tested real estate strategy for acquiring cash-flowing rental properties.

In BRRRR, there are two loans involved:

- The buy loan. The loan you use to close the house, do the rehab, and handle carry costs until you get a tenant. Real estate investors often use hard money for this, since it’s a short-term loan.

- The refinance loan. The loan that gets you out of the hard money and captures the equity you put in the house with your repairs.

A DSCR loan can be a perfect fit for many BRRRRs’ second, long-term, refinance loan.

Appraised Value vs Purchase Price for a BRRRR’s DSCR Refinance

DSCR loans come in many different products (interest-only, 30-year fixed, etc.). You can use any type of DSCR loan as a refinance for a BRRRR.

There is just one question you need to ask your lender: For the LTV on a DSCR refi, do you need to use the appraised value or the purchase price?

When you do a rate-and-term refinance with a conventional loan, the guidelines often allow you to use the appraised value. For DSCR loans, however, lenders write their own guidelines. The number used for the LTV varies from lender-to-lender, so it’s always important to ask.

A Fast Refi

You don’t want to be stuck in the hard money loan for very long at all. The ideal BRRRR reaches the refinance stage within 90 days. The interest rate on hard money adds up quickly. It’s important to figure out all the details of your refinance ahead of time so you can get through the process fast.

We’ve been doing BRRRR long before it was named that. Back in the day, we called it “Quick to Buy, Quick to Refi.” The old name emphasizes a part of the process that many current BRRRR investors miss.

To be quick to refi:

- Make sure you’re pre-qualified for the refinance loan, before you even close on the property.

- Understand when you can use the appraised value of the house. This will tell you how much money you’d have to bring into the refinance.

- Plan out whether you can get this BRRRR done with 100% leverage.

Refinance a Rental Property into a DSCR Loan with 100% Leverage

100% leverage means you don’t put any of your own money in – not for purchase, closing, rehab, or even carry costs. In 2010, we helped many clients do BRRRRs with zero money out-of-pocket. Those opportunities will be available again soon.

For a successful 100% leverage BRRRR, the property you buy has to be at least 25% undermarket. In a down market (like the one quickly approaching us now), you can find many properties for 25-40% below market value.

Example of a 100% Leverage BRRRR

What numbers do you need in order to figure out a zero down option for BRRRR? Let’s go over a couple examples.

The 75% Rule

As we’ve covered, the short-term hard money loan comes first, and the long-term refinance loan comes second. But you have to know what LTV you’re qualified for before you close on the loan.

For most cases with a rate-and-term refinance, you can qualify for an LTV of 75% of the current appraised value.

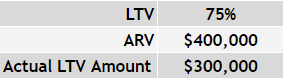

To get 100% leverage for your BRRRR, all of your costs have to stay under 75% of the after-repair value.. For example, if you had a property with a projected ARV of $400,000, a 75% LTV would leave you with a $300,000 loan (aka, 75% of $400k).

Now, the difference between the ARV and the LTV is the amount you get to budget for all your costs (purchase, closing, carry, and construction). In this case, that would be $100,000. Any costs above $100,000 end up coming out of your pocket.

Budget for Costs

Let’s continue with our previous example.

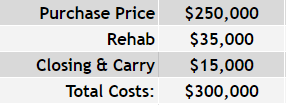

Let’s say the purchase price for this home was $250,000.

We’ve looked over the property, and we could do the full rehab for $35,000. Also, closing and carry costs will be at $15,000.

So, what does all this mean? If you can get a hard money loan for $300,000, then your whole project is covered. You can refinance the whole amount into a long-term DSCR loan and pay off the hard money, with nothing out-of-pocket for you.

Going Over-Budget

No money down is the ideal for BRRRR. There will be more opportunities upcoming for zero down properties.

But for the sake of example, let’s say your costs on a property can’t stay under 75% of the ARV. If the purchase and carry costs are the same, but the rehab will actually cost $65,000, that brings our all-in costs up to $330,000.

Yet even the best hard money lenders probably won’t be able to give you more than $300,000 for this property. That extra $30k comes out of your pocket.

This is why you need to know your BRRRR numbers ahead of time before buying a property. Too many people jump into a hard money loan, but can’t qualify for the amount they’ll need.

Help with Refinancing a BRRRR Into a DSCR Loan

Are you in a position to qualify for a 75% loan? Do you know what numbers your deal needs in order to get a good refinance? Have you found a property that could be a 100% leverage BRRRR?

If you need help answering these questions, send us an email at Info@HardMoneyMike.com. Let’s run the numbers on a hard money loan. We’d love to see you refinance your BRRRR into a DSCR loan.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!