How to Calculate Your Hard Money Loan Amount

What does your lender take into consideration to calculate your hard money loan? Here’s what you need to know.

How much could you get in a hard money loan?

At least 50% of your success as a real estate investor will come from using and understanding leverage well. Simply knowing your numbers gets you ahead of the curve.

You need to be able to figure out a ballpark number of what a lender will give you for your property. Let’s go over how to calculate your hard money loan, what costs you’ll need to know about, and run through some examples.

Calculate a Hard Money Loan: Maximum LTV

There are two main calculations for a hard money loan.

The first is: What is the maximum loan value a lender will offer?

Every hard money lender has a maximum loan ability. This maximum is based on the property’s after-repair value or ARV.

ARV is what the property will be worth at the appraisal when you sell or refinance. This is the number the property could go for on the open market after you’ve done all your renovations.

LTV vs ARV

Traditional lenders use “loan-to-value,” which means they base their loans on the cost of the property.

But hard money is designed for real estate investing, so they lend with the assumption that your property is value-add. It’s a property that needs work, and when you put in the work, the home will be worth more in the future.

The after-repair value is what hard money lenders base their loan on. Most lenders will lend somewhere between 70-75% of the ARV. However, the actual loan-to-ARV percentage you get depends on factors like experience, credit, etc.

Most hard money lenders will only approve a loan for an amount you can actually afford. These lenders want two things:

- To get their money back.

- For you to make money.

75% ARV is the average amount they can lend safely. This amount estimates that you’ll be able to both pay all your costs and still make a little profit for yourself.

Max LTV for Hard Money Example

Let’s look at an example. We’ll keep it as simple as possible and say our ARV is $100,000. This loan amount is likely unrealistic depending on your market, but this calculation works the same with any number.

If $100,000 is our ARV, that means it’s the absolute maximum any hard money lender could loan you. In rare situations, a hard money lender may loan you up to 100% of your ARV.

More common, however, is that you get 75% of your ARV. To figure out this number, you just multiply your ARV by .75:

ARV × % of ARV = Loan Amount

$100,000 × .75 = $75,000

$75,000 is the realistic maximum loan you can expect from a hard money lender for a property with an ARV of $100k.

Calculating the loan-to-ARV for a hard money loan is only the first calculation, though…

Calculate a Hard Money Loan: Maximum Actual Loan

If the first question is what is the maximum loan amount you can get, then the second question is: What’s the actual amount they’ll lend?

You might hear a hard money lender say they’ll lend up to “80/100” or “90/100” – let’s go over what that means.

How to Figure Out Actual Loan

You’ll notice there are two numbers with a slash in between.

The first number is the loan-to-cost (not ARV). For example, if it’s 90/100, that means they’ll lend up to 90% of what you bought the property for.

The second number is the rehab cost. In the 90/100 example, the lender would give you 100% of the costs needed to fix up the property.

So in this case, they’ll offer you a loan that covers up to 90% of the purchase price and 100% of the rehab costs.

But remember: there’s still the overall maximum loan of $75,000 that we can’t go over.

Calculate Your Costs for a Hard Money Loan

So say a lender tells you they can loan 90/100 and 75% of the ARV, and your ARV is $100,000. That means they’ll give you 90% of the purchase cost + all the construction costs, but that total number can’t be more than $75,000.

Let’s break this down with some simple examples.

Don’t Forget Closing Costs

We’ll say we’re buying a property for $60,000, and it will take $20,000 to fix up.

There’s one more number many real estate investors fail to include here: closing costs. This number includes:

- What you pay the title company, escrow attorney, or whoever performs the closing.

- Lender origination fees.

- Title costs.

- Insurance.

- Anything else that goes into the closing of a transaction.

Your closing costs will be dependent on your purchase price. For our $60k property, closing costs will be somewhere between $1,800 and $3,000. We’ll go with $3,000 for our example.

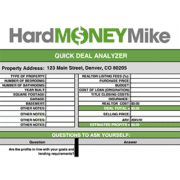

90/100 Hard Money Loan Example

Here are the numbers broken down for our current example. How do they work out for a 90/100 loan?

Purchase Price: $60k

Rehab Costs: $20k

Closing Costs: $3k

Total: $83k

Now, if the lender offers 90% of the purchase price, they’d cover $54,000 on this property. That leaves $6,000 (aka, 10%) you’ll have to cover.

They’ll also pay for 100% of the $20,000 construction costs. So as long as you stay in-budget, there will be no out-of-pocket costs there.

A hard money loan covers no closing costs. You’ll need to fund all $3,000 there.

Here’s what we’re left with:

Loan Covers: $74,000

You Cover: $9,000

Now you know going in that you’d need $9,000 to make this deal work.

You can also see that the $74,000 is less than the max LTV of 75% (or $75,000 on this case). But what if our rehab costs were actual going to be $25,000 instead of $20k?

This would push our loan coverage up to $79k. The loan would still only cover $75k, so you’d be stuck with an extra $4,000, totaling your out-of-pocket cost for this property to $13,000.

80/90 Example

To really drive this home, let’s go through the exact same example but with an 80/90 loan.

If the purchase price is still $60k, they’ll give you 80%, so:

$60,000 × .80 = $48,000

Rehab costs are still at $20k, so now the loan would cover:

$20,000 × .90 = $18,000

The total loan amount would be:

$48k + $18k = $66,000

Your total costs would be:

Purchase: $12,000

Rehab: $2,000

Closing: $3,000

Total: $17,000

For a 80/90 loan, you’ll need to bring in $8,000 more than you would a 90/100 loan.

Other Factors in Calculating a Hard Money Loan

This is a very basic way to calculate your hard money loan. Keep in mind these numbers will shift a bit depending on your qualifications, experience, and credit score.

But even a ballpark number keeps you prepared. And the better prepared you are money-wise, the better terms you can get.

Additional Costs on Your Property

The costs of real estate investing can add up. This is why it’s important to know before closing on a loan – or even before approaching a lender – what you can truly afford.

One more cost that’s easy to lose sight of in the midst of leverage is the carry costs once you actually own the property.

You’ll be paying interest and principal every month, plus the accumulation of taxes, insurance, and potentially HOA costs. These are all amounts that will be coming either out of your pocket or from gap funding sources.

More Info on Calculating Hard Money Loans

We hope this helps you as you navigate your real estate investment career. Our purpose is to make sure you use hard money correctly, knowledgably, and in the right positions.

Be sure to check out our YouTube channel for more real estate investing breakdowns.

If you have any questions, or a deal you’d like us to run the numbers on, we’d be happy to help. Email us at Info@HardMoneyMike.com.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!