How To Guarantee Profits in Real Estate Investing

Real estate isn’t a guessing game. Here’s a step-by-step guide of how to guarantee profits in real estate investing.

As a hard money lender, we want to see you actually make money on a flip.

We know firsthand that education is the first step to profit in real estate investing. Many people come to us with a fundamental misunderstanding of the numbers.

Any seasoned real estate investor can tell you: these numbers are all really simple. You just have to practice them. The more you understand, the higher your profits. There’s money in the money.

Don’t be scared off by the math involved in investing. Repetition is key. We’ll walk through the simple numbers, and show just how easy it is to guarantee profits in real estate investing.

The Fundamental Numbers

Let’s go through a simple deal analysis.

You’ll need to do a little research to find the numbers to plug into this equation. You can get most of this information from:

- The listing/seller

- The lenders you may work with

- Real estate communities (like Bigger Pockets, or local Facebook groups)

- Simple market research on sites like Zillow

- Your personal experience over time

We’ll walk through each number in our example step-by-step.

ARV & Purchase Price

After-repair value (or ARV) is what you can anticipate selling a property for after you fix it up. For our example, we’ll say our ARV is $200,000. Meaning, we can get $200k for this property when we go to sell.

Next is purchase price. This is the contract price – how much you bought the property for. In our example, the purchase price is $120,000.

Closing & Loan Costs

However, the purchase price does not include the closing cost. Beginner investors often fail to consider these.

Closing costs are what you owe the title company for closing the contract, plus the fees on the loan itself.

The title will be around $2k or $3k. Closing fees, appraisals, etc for your lender will be based on your loan amount – somewhere between 2 and 3 points. For all the closing costs, we’ll say $8,000 total in our example.

Rehab & Insurance

The next crucial number is rehab costs. What’s a realistic budget to make this property one someone would buy for $200k? For this example, we’ll low-ball a bit. Let’s say we already have some materials on-hand, and we’ll do a bit of the work ourselves. We estimate to fix up the home for $20,000.

Property insurance is the next cost to consider. Most lenders require property insurance in the case of theft, fire, weather damage, vandalization, or any other unexpected loss of property. We’ll say the insurance for our example will cost us $2,000.

At this point, all our costs add up to $150,000. Typically, people who come to us get about this far. They say, “We can finish this project for $150k and sell for $200k. That’s $50,000 in equity. All profit!”

But those people fail to factor in some final important payments: what it costs to hold and then sell the property.

Holding Costs

Between interest, mortgage, insurance, HOA, utilities… What’s the monthly cost to keep the property while you fix it up?

It depends how long it takes to complete and sell. Rehab can take anywhere between 2 months and 6 months. For our example, let’s say we hold for 4 months.

This number is impossible to calculate perfectly, but on average, you can estimate holding costs to be about 1% of your sale price every month.

Our 4-month hold works out to 4%, or $8,000 total.

Fees at the Sale

Once you go to sell, you now have realtors involved – both on your side as a seller and the buyer’s side.

Typically, the high end of realtor fees are 6%, occasionally as low as 4%. We’ll go with the high end for our example, and say these fees will cost us $12,000.

Also, you’ll have more closing costs on the sale of the house. There are some tricks investors can use here to lower the price, like doing a hold open. Let’s say this will cost us $3,500.

Total Fix-and-Flip Costs

We’ve finally factored in all the costs of our example property. In total, this fix-and-flip would cost us $173,500.

It’s vital to factor all costs in number when you’re doing the math if you want to guarantee profits in your real estate investing.

With a $200,000 ARV, our anticipated profit would be: $26,500. Not bad at all for a $200k house.

Calculations to Quickly Guarantee Profits in Real Estate Investing

There are a few quick calculations you can do to find out if a property is in the profit range or if the squeeze is too tight.

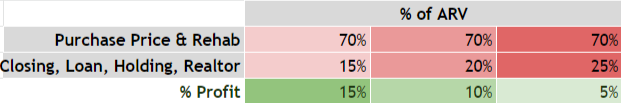

Start with your sale price. 100% of our example’s sale price is $200,000. What we want to know is:

- What percentage of that number should your other costs be in order to guarantee a profit in a real estate investment?

Purchase Price & Rehab

In real estate investing, it’s typical to have your purchase price below 70% of the ARV. (Keep in mind – the last few years have not been a typical market. Buyers had been overpaying, and leverage was easier to find. Don’t base your expectations here on the market from the last 2-3 years).

If your purchase price and rehab costs are around 65% or 70% of the after-repair value, it’s likely the flip will profit.

Closing & Loan Closing

The loan fees, closing costs, insurance, etc should cost somewhere around 5-6% of the ARV, at the high end.

It’s an important cost-saving measure to make sure you have some control over the insurance, maybe with a blanket policy. A great credit score can also cut these costs down pretty drastically.

Holding Costs

Holding costs can truly trap flippers in this market. However, as long as you buy good properties and do good rehabs, we’re still seeing houses sell quickly.

Most fix-and-flips that get stuck on the market are because:

- They’re at a higher price point (and buying power is low).

- The investor didn’t do their due diligence.

- The quality of the rehab is poor.

Ideally, you’re getting the house ready to sell in less than 6 months. So holding costs shouldn’t cost any more than 6% of your ARV.

Realtor & Closing Fees

As we shift into a buyer’s market, realtors become more and more important. It’s possible to negotiate with realtors, but these costs should stay around 4-6%.

You can also expect around 1.5% of the ARV for the second batch of closing costs.

How to Calculate Profit Based on Percentages

If you can estimate your costs’ percentage of ARV, you can guarantee profits in your real estate investment.

The percentage of costs added up have a direct impact on the percentage of profit leftover for you:

You should always aim for a minimum of 10% profit on a flip. The 10-15% range is even better.

In the example we’ve been using, our number for costs comes in at 86.75%. The leftover is profit, so 13.25%.

Floor vs Ceiling

Ideally, calculating these numbers gives you a floor – the bare minimum of what this property could earn you.

Then you’re left to find out the ceiling. As you gain more experience in real estate investing, you’ll find new ways to save money. Maybe cutting a little from purchase price, having a more efficient rehab, selling for a little over the ARV.

Not only can you guarantee your profits in real estate investing, you can make them skyrocket.

Sticking to the Numbers Guarantees Profit

Learn these numbers and stick to them. The number one way beginner real estate investors fail is that they go by emotions instead of math.

If you buy a property because it feels like it will work, or because you like it… You’ll probably lose money and hate real estate investing.

We want to see you try real estate investing and stick with it.

Visit our YouTube channel for more free info on real estate investing.

And reach out to us if you need help running through the numbers on a property. Send us an email at Info@HardMoneyMike.com.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!