How to Invest in Airbnb and Other Short-Term Rentals: The Money Side

Here’s your funding guide to invest in Airbnb, VRBO, or other short-term rentals.

You’ll find plenty of guides online about how to find good Airbnb locations or how to manage VRBO properties.

Our expertise is in financing those short-term rentals.

How can you find the easiest, fastest, cheapest funding for short-term rental properties? Let’s look at how to invest in Airbnb and get the money side right.

Why Do Airbnb Investments?

Maybe when you think of an Airbnb your mind still goes to the classic model: a family with a guest house rents out to tourists for a little extra money.

But short-term rental sites have evolved past that. Airbnb and VRBO properties can look a lot of ways, serve a lot of purposes, and generate a lot of income.

Airbnb Purposes

Airbnbs aren’t always for vacation rentals. The reasons people use short-term rentals are as diverse as the people themselves.

Sometimes Airbnbs are used as an alternative to hotels for traveling professionals. Or insurance companies will use VRBOs as temporary housing for people displaced by a house fire. Or companies will host remote workers for onsite projects in an Airbnb.

Some renters will stay for one night, some for three months. Some come to experience the location, some to have a personal retreat, and some because they’re preferred to hotels for longer-term stays.

There’s a wide variety of ways and reasons to invest in an Airbnb, VRBO, or other short-term rental. They’re a worthwhile investment – as long as you know the best ways to finance them.

Airbnb Investment Income

Short-term rentals are a great investment from a cash flow perspective.

If you invest in something like an Airbnb, it can quadruple (or more) the income you would make from a traditional monthly rental agreement.

If a traditional renter generates $2000 per month, short-term rates could make up to $4000 to $6000 per month on the same exact property.

So… How do you get the money to start?

How to Buy Your First Airbnb with No Money Down

If an investor decides to use short-term rentals as an income stream, ideally, they wouldn’t want to pay a bunch of money up front for the property.

Is it possible to buy your first Airbnb with no money down? What steps does it take to get 100% financing on a property to convert into an Airbnb?

Using the BRRRR Strategy to Invest in an Airbnb with No Money Down

A possible way to get a short-term rental with zero money down is to use the BRRRR strategy.

If you can buy a property undermarket, fix it up within budget, and refinance, you can set up an Airbnb for no money down.

We’ve helped a lot of people use the BRRRR strategy to get into an Airbnb. They keep the purchase and rehab costs at 75% or below the ARV, then get into a long-term conventional loan or DSCR loan.

The process is mostly the same as for a traditional BRRRR rental property, with a few slightly different requirements.

Long-term Loan Requirements to Invest in Airbnb

You’ll find conventional lenders that will lend for an Airbnb. But they may require that you have:

- Two years of experience with Airbnbs

- Other real estate investment history

- The income for the loan (from a W2 job or your own business) without any income from the property.

If you’d need a loan with fewer requirements for your first Airbnb, a DSCR loan may be right for you. A DSCR loan’s only major requirement is that the income from rent covers the expenses of the property.

What If You Can’t Get an Airbnb for Zero Down?

If you land a good BRRRR opportunity – find a property you can buy and fix up for under 75% of the ARV – you can get it with zero down.

Otherwise, you’ll be asked to put 20-30% down, depending on:

- Your credit

- Your income

- The income potential of the property

Later in this article, we’ll explore options for covering these down payments and other costs a loan won’t cover.

How to Invest an Airbnb Loan Without W2 Income

Many of these loans have income requirements. So what happens if you don’t have W2 income on your first Airbnb loan transaction?

If you need to get an Airbnb loan without W2 income, you can use a DSCR (Debt Service Coverage Ratio) loan.

Using a DSCR Loan to Invest in Airbnb

Maybe you started a business less than 2 years ago and you don’t yet have tax returns that qualify you for most loans. Or you just lost or left a job. Or maybe you recently moved.

In any of these circumstances, you probably won’t have the W2 income that qualifies you for most loans.

But DSCR loans will work for you because they only look at the potential or current rent for the property. Many, but not all, DSCR lenders will do Airbnb, VRBO, and other short-term rental loans.

DSCR Airbnb Loan Requirements

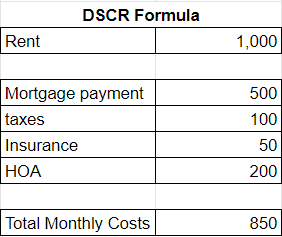

With a DSCR loan for a short-term rental, however, you don’t use the actual income amount you receive from Airbnb or VRBO. Instead, you’ll use the average rent in the neighborhood to qualify for your loan.

This means you can get a DSCR loan if the standard, monthly rent in the neighborhood would cover the property’s costs. So, that average rent amount must be greater than or equal to the property’s:

- Mortgage

- Taxes

- Insurance

- HOA fees

If the property meets those requirements, you can get an Airbnb loan without all the W2 income documentation required by typical loans.

Find the Right DSCR Loan for You

With DSCR loans, it’s very important to shop around. Every DSCR lender will offer a slightly different type of loan, with slightly different requirements.

There is a loan that is perfect for your credit, your plan, and your property. You just have to find it.

What Are the Best Loans to Invest in Airbnb?

Which loans and terms are best to invest in Airbnb? What should you look for?

Unfortunately, there’s no simple answer. Your loan options for short-term rental investments will come down to your credit, your income, and your experience.

Airbnb loans come in all shapes and sizes – 30-year fixed mortgages, adjustables, non-QM loans, interest-only, and more.

You’ll have to talk to lenders to see what’s out there. Here are a few things to keep in mind while you’re shopping around.

Down Payments

Every loan comes with different down payment requirements. These requirements are based on your situation, credit, income, location, size of property, and more.

Some Airbnb loans will only require 20% down, some up to 30%. If you’re not using BRRRR, you have to expect to put this extra money into the property.

Is that something you can afford? Will you be able to find alternative ways to fund that extra 20-30%?

Pre-pay Penalties

Most non-traditional loans and DSCR loans will come with pre-pay penalties.

You’ll agree to keep the loan on the property for, say, five years. So, if something comes up after two years and you sell, you’ll have to pay the lender an up to 5% penalty.

Getting a loan with a pre-pay can get you a better rate. But it becomes an expensive detail if you end up selling early.

Do you know how long you’ll keep the house? Is the rate on the loan with the pre-pay penalty worth it?

How to Get the Best Terms for Airbnb Loans

People get excited to invest in Airbnbs, but they fail to get sorted on the money side. You’ll have to search for the best terms.

The easiest way to improve your terms is to have the income, and, more importantly, the credit score that lenders are looking for.

Good terms on your loans lower your cost of funds and increase your leverage. It leaves more money in your pocket and less to the bank. Good terms are vital if you want to expand your Airbnb and other investments into a business.

Grow Your Airbnb Faster with OPM

You can get short-term rental loans from banks and hard money lenders. But one of the best strategies for funding Airbnbs is to borrow money from real people.

Using OPM Loans to Invest in Airbnb

Other People’s Money comes from family, friends, or anyone else with money they’d like a better return on.

Maybe they’re only getting a 1% rate in their bank account and want more from a real estate investor. Maybe they’re nearing retirement and want to start getting their money out of the stock market. Whatever a person’s situation, there’s a lot of money out there looking for better returns.

You can buy a VRBO with someone else’s money, then pay them back with interest at 5-6%. It’s cheaper for you, and double or triple what your lender would make keeping their money in a bank. Win-win.

OPM requires no credit or income qualifications, and it gives you a faster, more convenient money source to grow your Airbnb.

Setting Up an Airbnb Partnership with OPM

Instead of using OPM as a loan, there’s a way to structure it as a partnership.

In this case, you have no debt requirements. You can return their money with a rate of 5%, but if there’s a bad income month, you’re not obligated to pay.

As far as cash flow, you can’t beat an OPM partnership or loan. It can help you invest in Airbnbs with no money out of pocket, no qualifications, and potentially no debt.

If you need help setting up the OPM process, we’ve done thousands of OPM transactions and can answer any questions you have.

Where To Go From Here

There are a lot of loan options to kickstart your Airbnb investment career. The less money you have to put into the property, the better off you’ll be.

There’s money in the money – for all investments, including short-term rentals. Getting the money right makes everything smoother and your profits bigger.

Contact us at HardMoneyMike.com with any questions about your Airbnb investment journey.

Happy Investing.