DSCR Loan vs Conventional Loan: 11 Facts You Should Know

11 categories to consider a DSCR loan vs conventional loan.

In real estate investing, you come across two main loans: a DSCR loan and conventional loan. These are the main methods of financing everything from a single family up to fourplexes.

But how are they different? Most importantly: when should you use each one?

Let’s go over the differences between a DSCR loan and conventional loan.

What Are a DSCR Loan and Conventional Loan?

DSCR stands for debt service coverage ratio. A DSCR loan is specifically made for investors’ rental properties.

There are three main requirements for a DSCR loan:

- The property has value.

- You have good credit.

- Rent covers the property’s expenses.

While a DSCR loan is investor-only, conventional loans have a broader usage.

There are many types of conventional loans, which are also often called traditional, Fannie Mae, or Freddie Mac. Investors often use these loans for refinancing properties – both owner-occupied and rentals.

Which Loan Should You Use?

You’ll need to use both types of loans in your investment career.

Although there are tried-and-true investment techniques, every property will require something slightly different. Plus, depending on where you are in your investment career, credit, and income, the loans you’ll need will change.

Let’s compare and contrast 11 categories and discuss whether a DSCR loan or conventional loan has the advantage.

11 Things to Know About DSCR Loans vs Conventional Loans

- Income

DSCR loans only look at the rents on the property and whether it covers the expenses. They won’t bother with your W2s or other proof of income.

Traditional loans do consider W2s, tax returns, and other financial records from the past several years.

Advantage: DSCR

- Down Payment

Both DSCR and conventional loans typically require a 20% down payment. However, this can vary depending on your credit score.

Advantage: Neither

- Credit

DSCR loans may accept a lower credit score, as low as 640. Traditional loans may require a higher credit score – usually 680 or higher.

Advantage: DSCR, slightly

- Closing in a Business Name

Traditional loans only allow closing in a personal name. You can quick claim it later into your business name, but you must close in your name. DSCR loans let you close in an LLC – in fact, they prefer it.

Advantage: DSCR

- Time in Business

DSCR loans don’t care how long you’ve been in business, while traditional loans require at least two years of business income.

Advantage: DSCR

-

Loan Rates

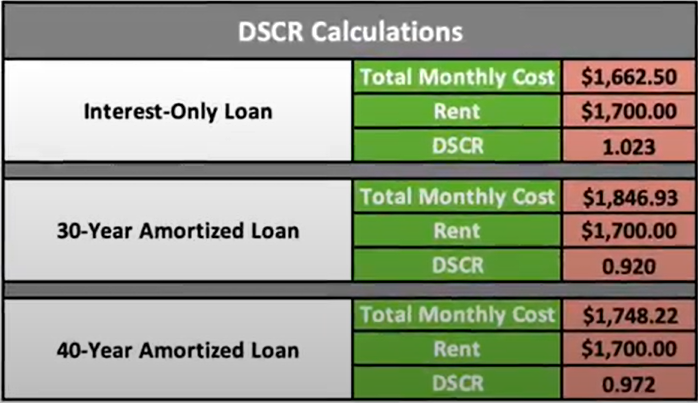

So far, it seems like DSCR loans have all the advantages. But when it comes to interest rates – one of the most important considerations for a loan – you’ll see it switch.

Conventional loans almost always have a 1-3% lower rate than a DSCR loan. This can be a deciding factor when you’re considering cash flow.

Advantage: Traditional

- Underwriting

DSCR loans require less documentation than traditional loans. Conventional loans ask for every possible piece of information. DSCRs only need your credit score, your LTV, and the property’s rent.

Advantage: DSCR loans.

- Cash-out Options

DSCR loans may offer cash-out options of up to 80% of the appraised value, depending on your credit. Traditional loans max out at 70%.

Advantage: DSCR

- Types of Properties

What if you have a property that has between five and eight units? Or what if you have a mixed-use property? The only one of these two loans that will even consider a unique property like that is DSCR. You can get conventional loans for only 4 units or less.

Advantage: DSCR

- Prepayment Penalties

A prepay penalty means you’ll have a fee if you pay off a loan within a certain timeframe. The lender wants to incentivize you to keep the loan on the property for a longer amount of time. DSCR loans usually have a standard prepayment penalty between 3-5 years. Traditional loans typically have no such penalty.

Advantage: Traditional

- Underwriting Guidelines

A nice thing about conventional loans is that they have standard, electronically underwritten guidelines. Any bank or mortgage company you go to will have the same “rules.”

With DSCR loans, on the other hand, every lender has slightly different requirements, underwriting, and rates.

Advantage: Traditional

When To Use a DSCR Loan vs a Conventional Loan

You might need both of these loans, so it’s important to understand the advantages and disadvantages of each.

Not sure where to start with finding a loan? That’s why you should work with someone like Hard Money Mike. We shop the nation for the best loans to match with our clients.

Email us at Info@HardMoneyMike.com with any questions.

If you need more help deciding if a DSCR loan is right for you, download our free DSCR calculator here.

Happy Investing.