5 Ways to Flip Properties During a Recession

Real estate investing can still be your career. Here are 5 tips to flip properties during a recession.

With prices going down, can you really make money on flips during a recession?

Some investors dabble in fix-and-flips while times are good in real estate. But there are other people who use real estate investing as their career, and they’re going to flip no matter what. How can those investors continue to be successful as money tightens up?

This is the third recession we’ve been through at Hard Money Mike. Here are 5 strategies we know work for flips during hard times.

1. Buy on the Lower End

What’s the medium price point in your community right now? Stick to that number and below.

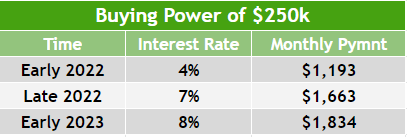

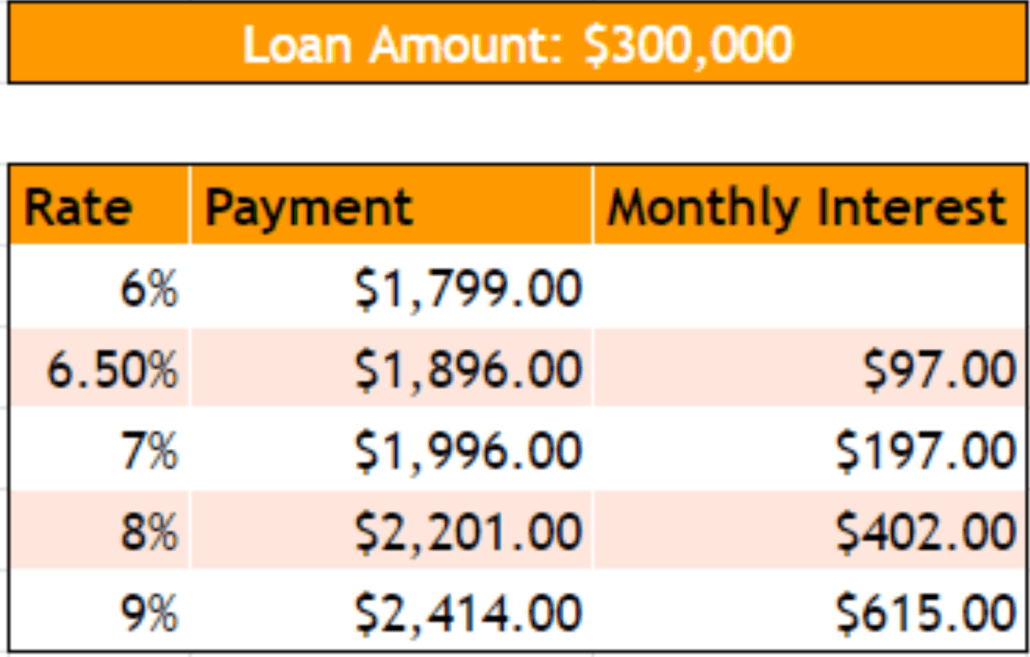

Interest rates will force any current buyers into a much lower budget. Payments on cheaper properties will still be close to (or cheaper than) rent, even if rates go up to 8 percent.

Affordability puts more buyers at a lower price point as a recession goes on. So you’ll make more money in the long run with lower priced homes.

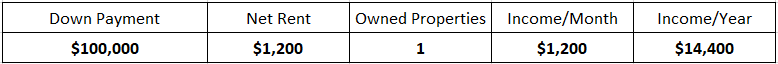

2. Only Buy Properties That Cash Flow

We don’t know what’s going to happen in the market. But we do know two patterns from past recessions:

- Homeownership will go down.

- Rent prices will go up.

If you’re flipping, you need to know the worst case scenario. Worst case for you is the house won’t sell, and you’ll need to convert it to a rental. You may have to keep this property for 6, 12, or 18 months before it will sell.

In the event you can’t sell when you need to, it’s important to make sure the property cash flows. Or at the very least, that you have the ability to refinance.

Another tip to keep in mind: if you may have to refinance and rent your property… don’t drop the price!

The appraiser values your home based on your last marking listing price. Every time you drop a property’s price, it drops loan availability and LTVs.

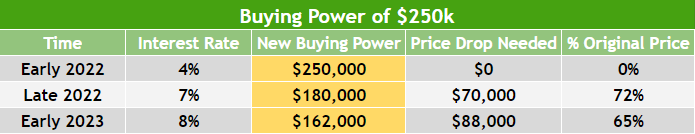

3. Start Cutting Your ARVs By 10-20%

This one’s hard for a lot of people who do flips. But to flip properties during a recession, this is a necessary step.

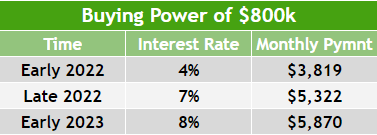

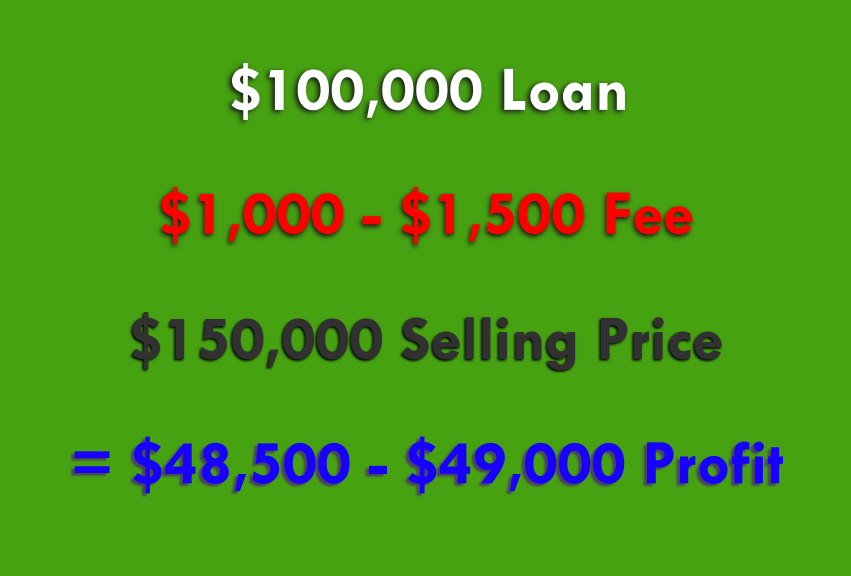

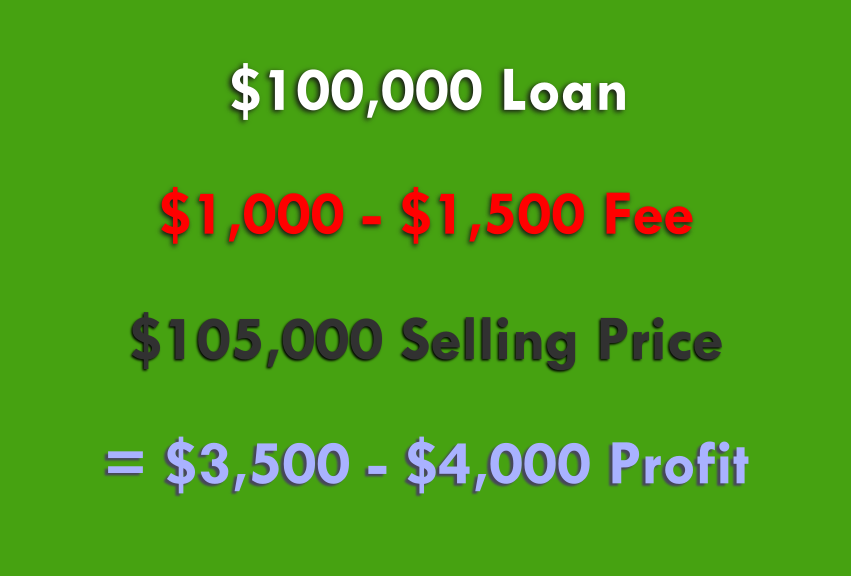

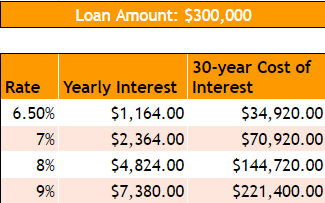

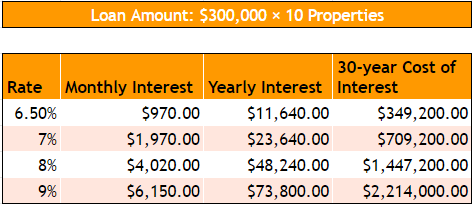

Interest rates are anticipated to rise from 7% this year to 8% next year. When interest rates rise 1 percent, consumers’ purchase power goes down 7-10 percent.

Say you had someone who could qualify for a $200,000 loan at a 7% interest rate. Then the rates go up to 8%. That same person would only be able to qualify for around $180,000.

You have to understand: as interest rates go up, prices go down and payments go up. And people buy based on payment.

To set yourself up for profit, take into account the upcoming increase in interest rates, and cut your ARV.

4. Look at a LOT of Deals, Buy Very Few

Most people who aren’t full-time fix-and-flip professionals have gotten out of the business. They won’t be back for at least another year or two.

Because of that, sellers will have more deals. Wholesalers have more available right now. There are also more real estate agents specializing in REI, so they’ll have deals, too.

With more deals available, it’s a great time to buy.

However, there will also be fewer buyers. So while it’s a good time to buy, be careful not to get stuck with a bad property and no buyers.

Look for properties that meet these criteria:

- In good areas

- At a lower price point

- Cash flow

Put in a lot of time to research properties. Jump on the best ones, and let the others go.

5. Quality matters

If you flip properties during a recession, focus on quality.

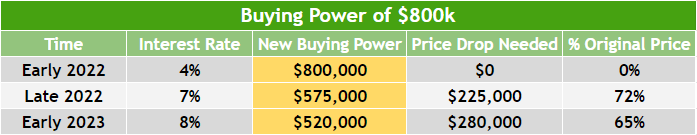

We had a client recently who learned this lesson. They were looking for a buyer that could have afforded a $800,000 house in January of 2022. Then interest rates skyrocketed. Come October of the same year, that same buyer could only afford $575,000.

Imagine the expectations of someone who was recently going to buy an $800,000 house and now can only afford $575k. They need to walk in and see a glimpse of the $800k quality.

At the very least, these potential buyers can’t walk in and think, “We’d have to start over.” If they feel they need to “start over,” they’re going to leave and find a better house.

Remember, there will be a lot of homes on the market – buyers have more options than just you. You can’t skip renovations and expect to sell fast or get the best price. Make sure you do quality work when you buy flip properties during a recession.

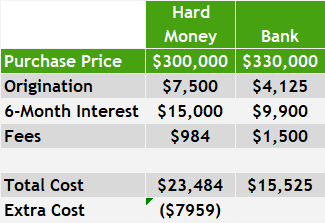

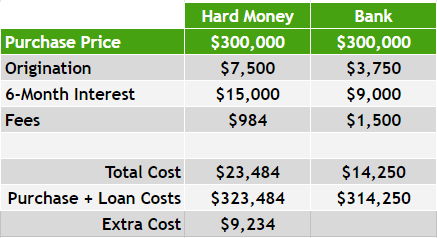

Getting a Loan to Flip Properties During a Recession

If you find a deal you want reviewed, send it our way! We’re still lending, and we’d be happy to help you fund a deal.

Email us at Mike@HardMoneyMike.com with deal information or questions.

Happy Investing.